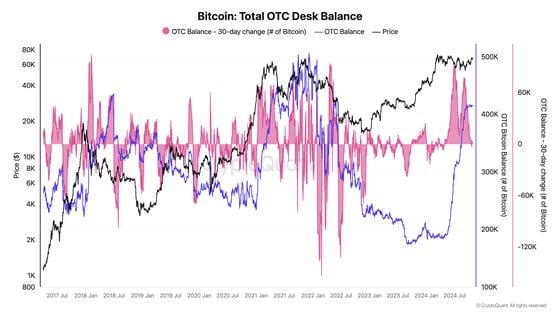

OverThe counter desks are holding 416,000 bitcoins worth $30 billion. This is the same level as it has been for the past month.

- Sophisticated Over-the-counter trading desks are used by investors and high net-worth individuals to execute trades, without affecting the spot market price.

- In In the last five months, OTC Desks have seen an increase of over 200,000 BTC. It is one of highest levels recorded in the recent years.

As Bitcoin (BTC) is nearing a new record high. It appears that sophisticated investors are taking steps in order to trade without influencing price on the spot market.

At As of noon, the current value is $72,300 EuropeThe largest cryptocurrency in terms of market value is only 2% less than the record of $73,798 set in MarchCoinDesk Indices data. Bitcoin The stock market has risen by about 14% in the last month, making it the biggest monthly gain since March.

According to CryptoQuant, a remarkable feature of the recent bitcoin run is the fact that over-the counter (OTC) tables, which allow two parties trade directly without disclosing any information to the larger market, now have 416,000 BTC ($30billion), compared to an average of less 200,000 BTC in the first quarter.

OTC desks can be used by high-net-worth individuals or institutions who want to avoid their transactions appearing on the order books of crypto exchanges. This allows them transact large amounts without affecting price. The Growing flow to OTC Desks is one of the reasons why the bitcoin price has trended in a sideways channel over the past 7 months.

With The exchange-traded fund (ETF) U.S. listed on spot could buy bitcoin without affecting spot price.

Even Tuesday’s Record daily purchases By the bitcoin ETFs represents just 2% the total bitcoin balance at OTC desks. During In the first three months, when bitcoin posted an all-time record shortly after ETFs received approval from the regulatory authorities, the inventory share ranged between 9 and 12%.

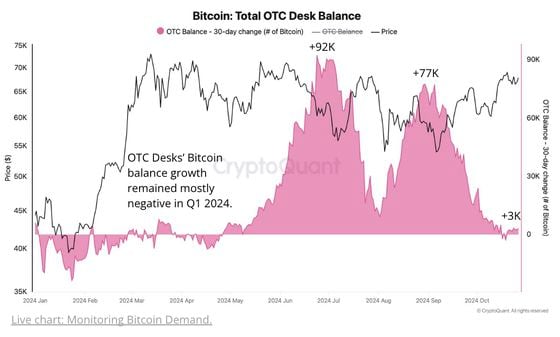

The Since the beginning of the year, however, total OTC desk balance has remained fairly stable. September. The A 30-day change of only 3,000 BTC is down from a June High of 92,000 BTC. During The pent up demand led to the negative 30-day change of OTC desk balances in the first three months, which helped propel this asset to its all-time high.

For In order for bitcoin to increase this cycle, daily flows into OTC desks should start to decrease, as observed currently. Daily Inflows to OTC desks have fallen to their lowest levels in this year. CryptoQuant notes the decline in OTC desks. OctoberOTC desks averaged 90,000 bitcoins, a 52% reduction compared to the first three quarters.

If The demand for BTC is expected to continue accelerating despite low inflows at OTC desks. This could push bitcoin to new heights.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.