The The next crypto bull market could be sparked by the U.S. elections combined with a more favourable monetary environment, according to experts. David Lawant.

Seismic Crypto-asset market cycles are often triggered by events. The The 2016-2017 crypto cycle was largely driven by industry, extending crypto’s reach past early adopters. In In contrast, the 2020-2021 surge has been propelled by unprecedented COVID interest rate reductions.

NowTwo powerful catalysts have converged: the looming U.S. elections in 2024 and a nascent liquidity cycle for risky assets. This Bitcoin’s trading range of $58,000 to $70,00 could be shattered by a powerful combination. This is where it has been for the most part since late MarchThis could spark the next major market move.

You’re Read more Crypto Long & ShortWeekly newsletter with news, analysis and insights for the professional investor. Sign Up here Get it delivered to your inbox each day Wednesday.

Elections in 2024 will gain importance as the day of the election approaches

This Election cycle This year marks a number of firsts for the crypto industry, most notably how it became a topic of discussion in political discourse and campaign funding. Another Interesting trend is how Polymarket, A breakthrough crypto applicationNow, a consensus estimate of election results can be obtained in real time. There is over $1 billion on the line.

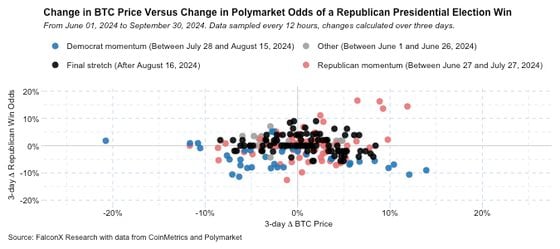

The The chart below shows a relationship between two factors during 3-day periods. Republican Win the odds Polymarket Changes in bitcoin prices can be used as a proxy to measure the overall performance of the crypto market. Different The color-coding of the phases of voting is: gray for phase one (before June 26), red for a period of Republican The momentum (between the end and June The end of July), blue for Democratic Gains (between the end and July Mid-termAugustThe final stretch is black (since mid-way).August).

If The market has linked crypto prices directly to Republican The dots in the chart would form a 45-degree upward-sloping line. Conversely, a direct link to Democratic A similar line, but with a downward slope, would indicate a win. InsteadWe see a scattered cloud, which indicates that there is no clear trend between election results and crypto prices.

This The scatterplot shows that the dynamic nature of the scatterplot is visible in all phases, which are highlighted with different colors. Although Relationships are stronger during the phase Republican Momentum still explains less that 20% of the bitcoin price movements.

This The elections are not unimportant to the crypto price. It It is possible, but not likely, that the relationship will strengthen as we approach Election DayIn less than one month,. But This inconsistency suggests that other factors are also influencing the crypto market’s price.

Interest Crypto prices to be governed by a new regime

Recent Global liquidity shifts has driven markets around the world, including crypto. The Federal Reserve’s This rate-cutting cycle is off to a strong start, coupled China’s Surprising market-lifting MeasuresCrypto’s recent price rise is likely due to.

Unlike Crypto does not have extensive historical data to gauge returns across different interest rates regimes.

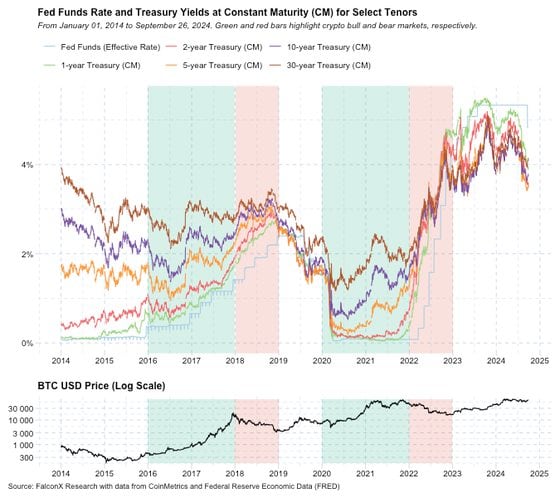

NeverthelessIt is instructive to compare crypto prices with rate environments. The The chart below shows a comparison between the effective federal funds rates and the chart below. Treasury From 1-year to 30-year tenors, constant-maturity returns are available. For The lower chart is a graph of the bitcoin USD price (in a log scale for context), with colored market cycles: Green for the 2016-2017 and the 2020-2021 bull market, red for the 2018 bear market.

This chart suggests that a soft landing with lower rates — the current investor consensus — would create an unprecedented macro backdrop for crypto. This The COVID era rate-cut-fueled 2020-2021 surge is different than the industry-driven 2016-2018 cycle.

ConsequentlyIn the near future, macroeconomics factors are expected have a significant influence on crypto prices, as shown by the increasing correlations between cryptocurrency and risk assets.

Looking ahead

Low Crypto currency following Labor Day This indicates a market that is in a wait-and-see state. While While geopolitical tensions, supply/demand imbalances and other factors can still affect the market’s direction, the upcoming elections and global liquidity levels are the two most important drivers for the market into 2025. The The next one to three month will be crucial for revealing the future of these trends.

Note: The The views expressed in this article are those of the author, and not necessarily those of CoinDesk. Inc. Or its owners and affiliates.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.