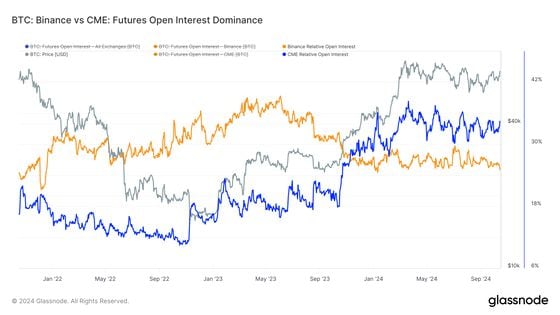

CME futures open interests nears an all-time high of 165k BTC. This signals a mature and stable market.

- Bitcoin Futures Open interest is approaching all-time peaks, with a current value of approximately 478k BTC (approximately $31.8 billion).

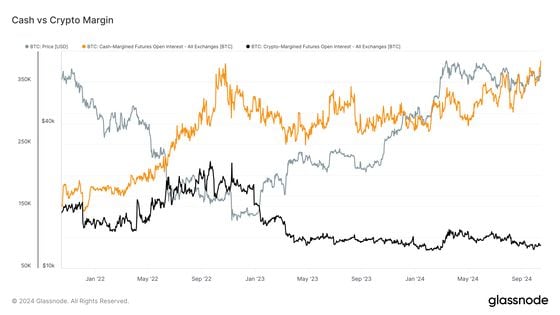

- Open Interest in cash-margined Futures has reached a record high of 384k BTC (approximately $25.5 billion), primarily due to institutional activity at the CME.

- Crypto-margin, as a percent of total open interest, is nearing a historic low. It is currently around 18,5%.

CashFutures contracts with margined Bitcoin (BTC) are more popular than before.

Open On September 25, 2018, interest in cash-margined derivatives hit a new high of 384,000 BTC. MondayExceeding the November According to data, the peak in 2022 will be 376,000 BTC. This is when bitcoin was trading at around $16,000. Glassnode.

The CME futures accounted 40% of the cash-margined total on Monday. Glassnode’s The charts for cash and crypto margins include standard futures (excluding perpetuals). Binance, Bitfinex, BitMEX, Bybit, CME, Deribit, Huobi, Kraken OKX.

CashThe open interest for -margined products has steadily increased over the last two year, while the open interest for crypto-margined products has steadily declined, from 210,000 BTC at the beginning of 2014 to just 87,000 BTC today, which is only 18.2% the total open interests of 478,000 BTC.

Glassnode defines crypto-margin as “the total amount of futures contracts open interest that is margined in the native coin (e.g., BTC) and not in USD or stablecoin.” The firm defines cash-margin as “the total amount of futures contracts open interest that is margined in USD or USD-pegged stablecoins. Stablecoins include USDT and BUSD.”

Open Interest (OI) is the number of active futures contracts that are open or active at any given time. An Open interest increases are said to be a sign of money flowing in and a preference for leveraged financial products. Open Interest can be calculated in native tokens and notional terms. The The latter can be misleading as it is influenced by underlying asset price.

CashMargined contracts cause less volatility

In Cash-margined futures contracts use stablecoins or dollars as collateral, which is more stable than the tokens used in the crypto-collaterized contracts.

As Cash-margined contracts, on the other hand, are less vulnerable to forced liquidations. They also tend to be less volatile. UltimatelyThis could provide a more durable bull run going into 2025.

The CME’s dominance in the cash-margined segment indicates increased institutional activity in derivatives markets. Sophisticated Investors can use CME futures as a hedge for their directional trades or to set up a market-neutral basis.

In October CME became the world’s largest futures market for the first time in 2023. They captured over 30% and overtook the previous leader. Binance. This The increase in the price of spot ETFs was likely due to traders pricing in the anticipated debut of U.S.-based ETFs that went live January.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.