The Recent price movements in crypto markets in context November 20, 2024.

This This article was originally published in First Mover, CoinDesk’s daily newsletter that puts the latest moves on crypto markets into context. Subscribe Get it delivered to your inbox daily.

Latest Prices

CoinDesk 20, Index: 2,981.79 +0.61%

Bitcoin (BTC): $93,634.61 +2.04%

Ether (ETH): $3,090.71 -1.65%

S&P 500: 5,916.98 +0.40%

Gold: $2,628.53 -0.15%

Nikkei 225: 38,352.34 -0.16%

Top Stories

Bitcoin (BTC), is looking to reach record highs again heading into Wednesday’s U.S. session. The The largest crypto is trading at just below $94,000. This is the new record. Tuesday, and the broader markets with a 2% increase over the past 24-hours. MeanwhileCoinDesk 20, the wide-market CoinDesk, is now available. Index There was little change and altcoins with large market caps ether (ETH), and solana(SOL) fell. Options BlackRock’s spot Bitcoin ETF (IBIT), saw First-day trading activity is staggering Analysts noted that yesterday’s BTC price increase was a result of the BTC market. Most Calls were the most popular, representing a bullish viewpoint. Some traders even bet on IBIT’s share prices doubling. “It’s pretty interesting to see ‘professionals’ degen into $100 strikes (this effectively means a doubling of BTC prices given IBIT trades near $50),” crypto quant researcher Samneet Chepal noted. Options Other BTC ETFs will follow In the coming days, more activity will be fueled. It’s Not only bitcoin is the focus of crypto activity. Trading Volumes for popular altcoins XRP (XRP), and dogecoin (DOGE). Overcome BTC’s on South Korean crypto exchanges Upbit You can also find out more about the following: Bithumb.

MicroStrategy (MSTR) Breaking into the Top 100 U.S. Publicly traded companies Market capitalization Shares closed at a price of $0. Tuesday’s Session at a record of $430, far beyond its dotcom bubble heights. The The largest corporate bitcoin treasury is owned by a firm whose shares have risen 528% in the past year, outperforming both bitcoin and chipmaker titan Nvidia (NVDA). The CoinDesk analyst: CoinDesk continues to see positive developments for the firm James Van Straten noted. On MondayIt announced the issuance of a $5 billion convertible senior note with a coupon of 0%. “We are waiting on further developments if this convertible note has been oversubscribed, which would increase its issuance by $250 million, for a total of $2 billion,” Van Straten said.

Robinhood (HOOD ) is Most likely to benefit Crypto deregulation in the U.S. President-elect Donald TrumpBroker Bernstein Said in a news report. The The report stated that trading apps can increase revenues by listing new crypto products and tokens to target a wider market. Robinhood’s Acquisition of EU-based exchange Bitstamp Its European Platform Should “further boost value added crypto services,” The authors wrote. Bernstein Raising the price target for Robinhood Shares to $51 per share from $30, which is a 45% increase. Tuesday’s The closing price is the final price.

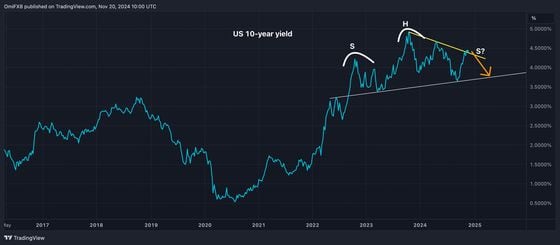

Chart You can also check out the Day

- This This chart is one of the most important charts in financial markets. The The yield on the U.S. 10 year note, also known as the risk-free rate is at a critical level.

- It The price could break above the downtrend or turn lower to form a head-and shoulder top. The The latter is likely to be good for risk assets unless it is accompanied by a ‘black swan’.

- Source: TradingView

– Omkar Godbole

Trending Posts

Coinbase Delists Wrapped Bitcoin wBTC, Citing ‘Listing Concerns’

Crypto Exchange Archax You can also find out more about the following: Offer Tokenized Money Market Funds The following is a list of the most recent and relevant articles. State Street, Fidelity International LGIM

Meta’s Mark Zuckerberg Could Teach DAOs, Like Compound. Governance Lesson

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.