The The next crypto bull market could be sparked by the U.S. elections combined with a more favourable monetary environment, according to experts. David Lawant.

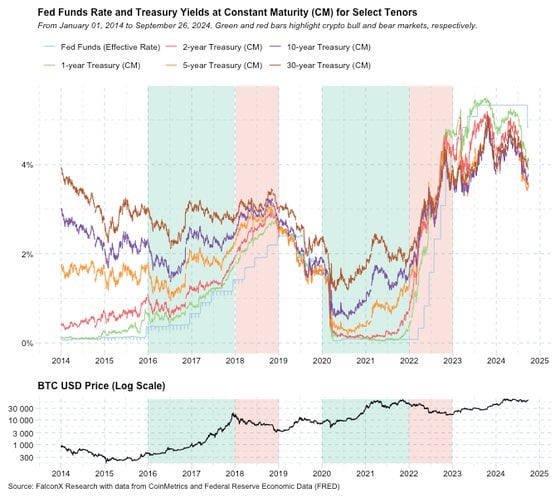

Seismic Events often trigger crypto-asset cycle transitions. The The 2016-2017 cycle was driven primarily by the industry, extending crypto’s reach past early adopters. In The COVID era interest rate cuts were the driving force behind the surge in 2020-2021.

NowTwo powerful catalysts have converged: the looming U.S. elections in 2024 and a nascent liquidity cycle for risky assets. This Bitcoin’s trading range of $58,000 to $70,00 could be shattered by a powerful combination. This is where it has been for the most part since late March, which could ignite the next major movement in the market.

You’re Read more Crypto Long & ShortWeekly newsletter with news, analysis and insights for the professional investor. Sign Up here Subscribe to our newsletter and receive it every month. Wednesday.

Elections in 2024 will gain in importance as the day of the election approaches

This Election cycle This year marks several crypto firsts, including how the industry became a topic of discussion in political discourse and campaign funding. Another How to make a trend? Polymarket, A breakthrough crypto applicationThe consensus on election results is now available in real-time, with more than $1 billion at stake.

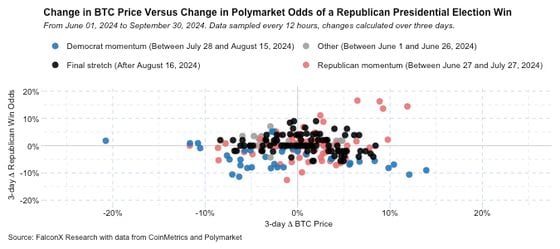

The The chart below shows a relationship between two factors over a 3-day period: Changes in Republican Win odds on Polymarket And changes in the bitcoin price as a proxy of overall crypto market performance. Different The color-coding of the phases of voting is: gray for phase one (before June 26) red for the period Republican Momentum (between the end of June The end of JulyBlue for Democratic Gains (between end of July The mid-sectionAugust), and black for the final stretch (since mid-August).

If The market linked crypto price directly to Republican If you want to know your odds of winning, the dots on the chart above will form a 45 degree upward-sloping curve. Conversely, a direct link to Democratic The line would be similar but sloped downward. InsteadWe see a scattered cloud, which indicates that there is no clear trend between election results and crypto prices.

This Dynamic is evident in all phases highlighted by different colors on the scatterplot. Although Relationships are stronger during the phase Republican It still only explains 20% of bitcoin’s price movements.

This The elections are not unimportant to the crypto price. It It is possible if not probable that this relationship will grow stronger as we get closer Election DayIt is now less than a month away. But This inconsistency suggests that other factors have also dominated the crypto market’s price action.

Interest Crypto prices to be governed by a new regime

Recent Global liquidity shifts has driven markets around the world, including crypto. The Federal Reserve’s The rate-cutting cycle has started off well, coupled with China’s Surprise market-lifting MeasuresThe recent crypto price surge is likely due.

Unlike Unlike equities and crypto, which have extensive historical information to compare returns between different interest rate regimes, cryptocurrencies do not.

NeverthelessExamining crypto prices in relation to rate environments is still instructive. The The chart below shows the effective federal fund rate alongside Treasury Constant-maturity yields are available from 1-year to 30 year tenors. For The lower chart shows the USD price of bitcoin (in log scale to give perspective) with color-coded cycles: green for 2016-2017 bull markets and 2020-2021 bear markets, and red for 2018 and 2022 bear market.

This chart suggests that a soft landing with lower rates — the current investor consensus — would create an unprecedented macro backdrop for crypto. This The scenario is different from the 2016-2017 industry-driven cycle and the COVID-era, rate-cut fueled, 2020-2021 surge.

ConsequentlyAs evidenced by the strengthening correlations between crypto assets and other risk assets, macroeconomic factors will likely have a significant impact on crypto prices in near-term.

Looking ahead

Low Crypto liquidity Following Labor Day This indicates a market that is in a wait-and-see state. While While geopolitical tensions, supply/demand imbalances, and other factors can still affect the market’s direction in 2025, the upcoming elections and global liquidity levels are the two most important drivers. The In order to understand how these trends will develop, the next one-to-three months are crucial.

Note: The The views expressed here are those solely of the author. CoinDesk does not necessarily endorse them. Inc. Or its owners and affiliates.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.