A speculative frenzy has gripped the market. This could lead to a sudden shift in sentiment and price volatility.

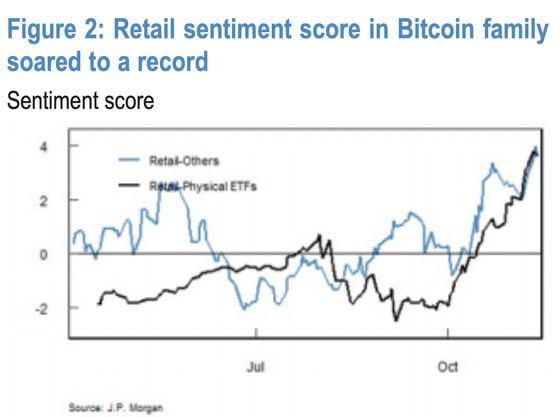

- JPMorgan’s retail mood score for BTC assets and BTC-related assets reached a new high last week.

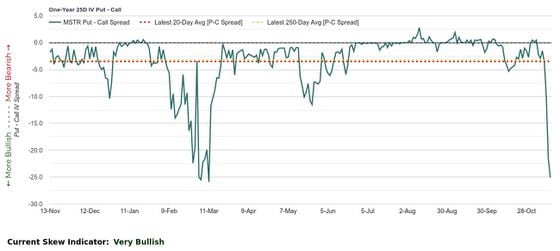

- MSTR’s option market displayed extreme fear of upside or bullish speculation frenzy.

Bitcoin Since the beginning of 2018, (BTC), and all other cryptocurrency, has been on a fire. Donald Trump The U.S. Presidential election was won on Nov. 5. Those Looking to get on the crypto freight train should be prepared for possible twists and turns as data tracked and analyzed by JPMorgan and analysts show things are getting frenzied.

As BTC passed the $93,000 barrier last week. Inflows into U.S. listed spot ETFs, crypto stocks, and crypto stocks soared. JPMorgan’s retail sentiment score reached a record high. The This measure is intended to gauge the sentiments of retail investors towards cryptocurrencies and bitcoin in particular, based on activity in the BTC product family, including spot ETFs.

“Within ETF space, demand for Bitcoin ETFs was particularly strong (IBIT +3.4z) following the election results. The demand for Bitcoin was also reflected in COIN (+6z). In fact, their sentiment score for the Bitcoin family (for both physical ETFs and others) soared to a multi-sigma high,” In a note sent to clients last Thursday, JPMorgan’s Equity Research team discussed the retail order imbalance.

The A z-score of 3.4 or higher indicates a substantial positive deviation from the mean, which indicates strong demand.

MeanwhileThe options market linked to shares of Bitcoin-holder MicroStrategy MSTR exhibited a record positive sentiment, also pointing towards the frenzied trades often observed during market peaks.

The The skew of the 25-delta call skew over a one-year period has plummeted to -26.7%. Wednesday. It According to a chart from Market Chameleon Shared by pseudonymous analysts Markets&Mayhem On X.

The The skew has recovered to -11.8% Friday, displaying a solid bias towards upside bets. BTC calls are consistently more expensive than puts, though the difference is much smaller than MSTR.

“Call skew in MSTR is so wildly euphoric that it is hard to imagine we don’t see a more meaningful drawdown unless bitcoin continues to move in a parabolic fashion higher. For now, it appears to be cooling off just a little bit from its highs,” Markets&Mayhem said.

Authors The following are some examples of how to use TheMarketEar analytics service refers to the skew in a certain way “beyond extreme upside fear.”

SoWhile BTC and other crypto assets may be good long-term investments for retail investors, the surge in sentiment can be unpredictable and lead to a sharp market reversal.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.