Bitcoin Since then, the company has added an additional $30,000 Donald Trump The U.S. president has won the election and is close to a $2 trillion market capitalization.

- Bitcoin The CME Exchange has seen a 218,000 BTC ($21.3billion) increase in open interest for futures.

- The The market cap of cryptocurrency is close to a historic milestone of $2 trillion.

- According to K33’s research, the CME growth comes largely from active and directly involved participants.

Bitcoin (BTC), by far the largest token in terms of market capitalization, has reached a market cap of $2 trillion for the first time. Its price has increased by $30,000 since Donald Trump The U.S. Presidential election was won at the beginning this month.

Currently At $1.93 trillion a price of around $101,000 per Bitcoin would reach this milestone. The BTC price crosses $97,000 for the very first time Thursday, and its dominance on the market reached a peak of just below 61.8%.

According The following are some of the ways to get in touch with us: Coinglass Data on bitcoin futures open Interest (OI) Chicago Mercantile Exchange (CME), which hit a record of 218,000 BTC ($21.3billion), was more than a third above the previous level. Nov. 5 election. Rising Open interest is a good sign of a bullish market when prices are rising.

“The relentless surge in CME open interest shows no sign of stopping; back-to-back all-time highs,” Velte Lunde, head researcher at K33, posted a message on X. “To contextualize, the growth in CME OI over the past 15 days is larger than the average notional open interest on CME in any year before 2022.”

Lunde It is important to note that the rally is being led by active and direct participants in the market. This The futures market is where cohort has direct exposure, but other growth sources could have come from exchange-traded fund (ETF) based on futures such as ProShare Bitcoin ETF (BITO), CoinDesk’s report last month.

The CME Futures will also benefit from the introduction of options linked to U.S. Spot ETFs.

“CME open interest crosses 200k BTC, with active market participants continuing to be the force moving exposure higher. Expect CME futures to continue to thrive with the launch of ETF options”, Lunde wrote.

Volatility The number of people who use the internet should decrease with time

The The more bitcoin is integrated with the traditional financial system (TradFi), the more likely it will be that volatility will decrease over time. We The realized volatility has declined from over 100% in the past few years to approximately 40%. Glassnode data.

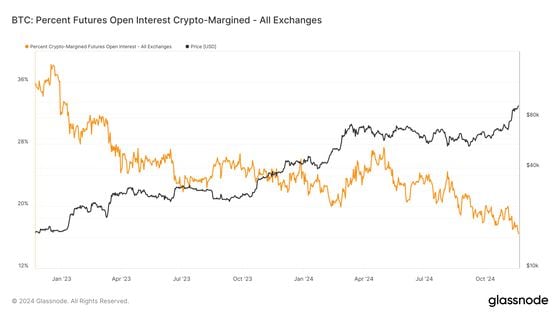

CashMargin contracts are at an all-time peak. These Stablecoins and U.S. Dollars are used as collateral for contracts, which are inherently non-volatile. That’s Crypto collateral, on the other hand, is volatile.

CME uses cash margin only for futures’ open interest, whereas retail-focused markets such as Binance Crypto margin is acceptable. Glassnode The CME is the market leader in the open interest futures market, with a 33% margin.

Glassnode Data shows that only 16% of futures are margined using crypto, and not cash. The The lower the number the less volatility we expect to see in bitcoin prices.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.