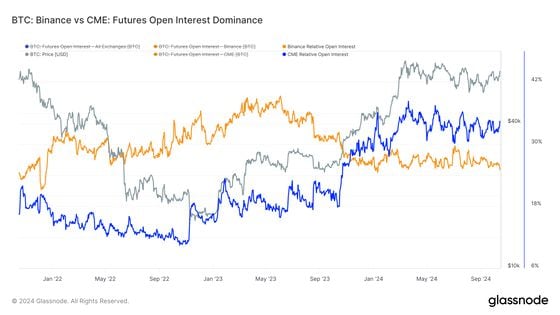

CME futures open interests nears an all-time high of 165k BTC. This signals a mature and stable market.

- Bitcoin Futures Open interest is approaching all-time peaks, with a current value of approximately 478k BTC (approximately $31.8 billion).

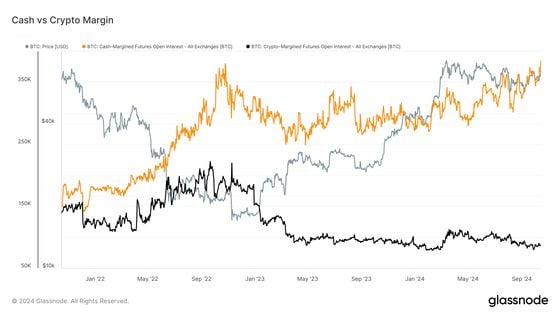

- Open Interest in cash-margined Futures has reached a record high of 384k BTC (approximately $25.5 billion), primarily due to institutional activity at the CME.

- Crypto-margin is currently at a record low of around 18.5%.

CashFutures contracts with margined Bitcoin (BTC) are more popular than before.

Open On September 25, 2018, interest in cash-margined derivatives reached an all-time-high of 384,000 BTC. Monday. surpassing the November Data source: 2022 peak of 376,000 BTC when bitcoin traded at $16,000. Glassnode.

The CME futures represented 40% of the cash margined tally. Monday. Glassnode’s Cash and crypto-margin chart includes standard futures data, excluding perpetuals. Binance, Bitfinex, BitMEX, Bybit, CME, Deribit, Huobi, Kraken OKX.

CashThe open interest for -margined products has been steadily increasing over the last two year, while the open interest for crypto-margined products has steadily declined, from 210,000 BTC at the beginning of 2014 to 87,000 BTC today, which is only 18.2% the total open interests of 478,000 BTC.

Glassnode defines crypto-margin as “the total amount of futures contracts open interest that is margined in the native coin (e.g., BTC) and not in USD or stablecoin.” The firm defines cash-margin as “the total amount of futures contracts open interest that is margined in USD or USD-pegged stablecoins. Stablecoins include USDT and BUSD.”

Open Interest (OI) is the number of active futures contracts that are open or active at any given time. An Open interest increases are said to be a sign of an influx of money and a preference for leveraged financial products. Open Interest can be calculated in native tokens and notional terms. The This is because the price of the underlying asset can influence it and be misleading.

CashMargined contracts cause less volatility

In In cash-margined contract, the collateral used is stablecoins, dollars or other stablecoins, which are more stable compared to tokens used for margin in crypto-collaterized derivatives.

As Cash-margined contract are less susceptible to forced liquidations, and they also cause less volatility. UltimatelyThis could lead to a more sustained bull run in 2025.

The CME’s leading position in the cash-margined segments suggests increased institutional activity on the derivatives market. Sophisticated Investors may use CME Futures to hedge directional plays or establish the market-neutral base trade.

In October CME will become the largest futures exchange in 2023. It will have captured over 30% of the market and surpassed the other major exchanges. Binance. This The increase in the price of spot ETFs was likely due to traders pricing in the anticipated debut of U.S.-based ETFs that went live January.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.