CME bitcoin futures interest reaches a record high, driven primarily by active and direct participants. Research.

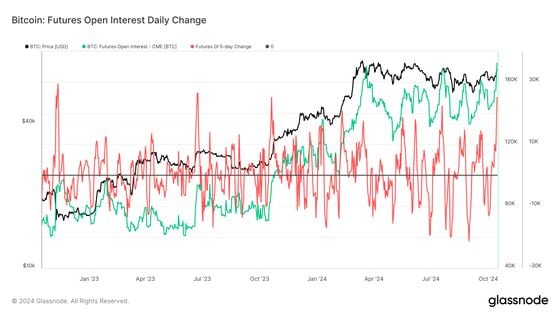

- Bitcoin The CME exchange’s futures open interest has reached a record high of 172.430 BTC ($11.6 billion).

- Over CME bitcoin futures saw a 25125 BTC increase in the last five trading days. This is one of the largest recorded changes since recent times.

Bitcoin Open interest (OI), on the BTC futures. Chicago Mercantile Exchange (CME) reached a new record of 172,430 BTC (11.6 billion dollars).

On TuesdayCoinDesk reported a new record for cash-margin interest, with CME accounting 40% of the total. Open Interest is the number of active or open futures contracts at a given time.

In CME’s open interest has increased by 25,125 BTC in the last five trading days. This This is the highest level recorded in recent times over a period of five days.

The The last time we saw a similar build-up was June 2023 (26.525 BTC), which coincided to the BlackRock filing for spot bitcoin ETF, iShares Bitcoin Trust (IBIT). During During this time, bitcoins soared from $25,000 to $30,000.

Then, October CME will add 25,115 BTC by 2023. This coincides with CME becoming a major futures exchange, surpassing the NASDAQ for the first. Binance. Once In this period, the period is from October The value of bitcoin at year-end rose from about $25,000 to over $40,000

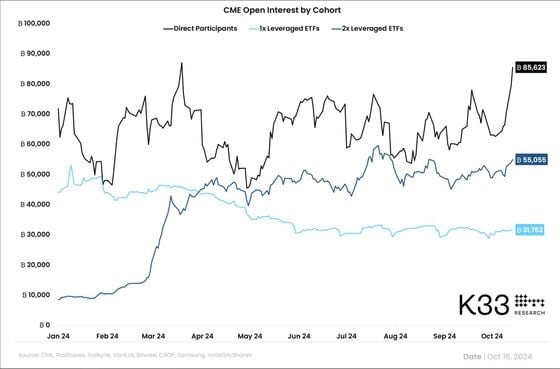

Vetle LundeSenior analyst at K33 ResearchThis milestone was also highlighted and the cohorts driving this growth were explored.

Lunde Note that the growth of the CME is not driven by futures-based ETFs like ProShares, but rather by active and direct market participants. Bitcoin ETF (BITO)

“The growth is clearly driven by active/direct market participants – not inflows to futures-based ETFs”.

The Chart below by Lunde, shows the breakdown of open interest for each cohort on CME. Active Direct participants hold 85,623 BTC, a similar amount as in March When bitcoin reached its all-time high.

HoweverThe 1x leveraged ETF is down steadily throughout the year. It now holds just 31,752 BTC. WhileThe 2x leveraged ETF has seen a significant increase in March Since then, the growth has been very slight. This In the early part the year, speculation and leverage were the main drivers of the market. However, they are no longer the main drivers.

Lunde Note that the activity is structured around the November After the U.S. election, expiry will occur.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.