Published at 21 September 2025, 23:14

Stellar alignment achieved: 21-09-2025 23:14 GMT+2 Time Zone

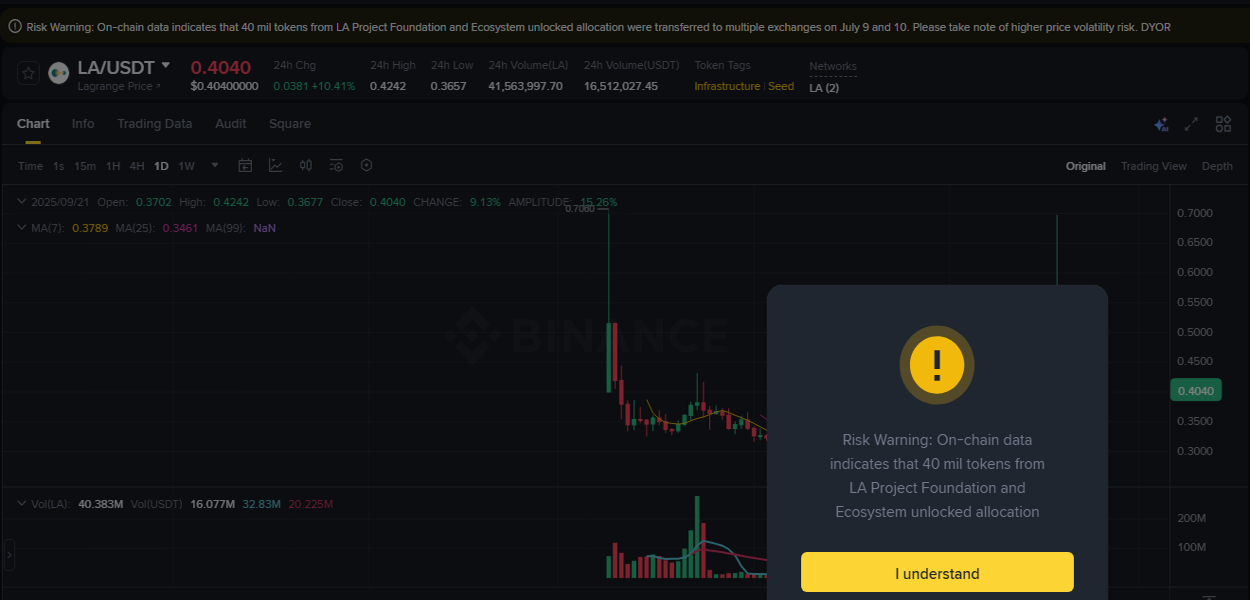

🌟 #LA/USDT Binance reached its stellar moment of glory! Ascension to 2 took 5 Hours 30 Minutes, illuminating VIP observers with brilliant 4.02% profit light! When cosmic stars align correctly, pure magic manifests in reality! ✨

Your personalized trading horoscope awaits in VIP! 🔮

👇Star chart (VIP forecast) documented below

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89950

Market Analysis LA:

🎯 ADX 39.8 demonstrates emerging direction with trend establishment potential. Modest ADX positioning indicates developing directional measurement reflecting limited momentum strength.

📄 EMA characterizes strong exponential crossover creating conditions for significant price depreciation. Exponential average analysis demonstrates strong bearish positioning indicating significant downward trajectory confirmation with statistical boundaries.

⭐ Bollinger 0.7 characterizes volatility expansion. Statistical band analysis exhibits compression level suggesting measured price displacement below equilibrium parameters.

🔍 Volume 12.9K demonstrates heightened market interest with expansion signs. High volume measurement demonstrates increased trading activity indicating enhanced institutional engagement.

⚡ TEMA 0.4 reflects powerful triple exponential resistance creating substantial decline with strong negative acceleration buildup. Exhibits robust triple exponential weakness with substantial potential and institutional selling.

📊 AD -916.6K presents ultimate accumulation strength with explosive force and institutional interest backing. Manifests critical AD positioning, pointing to unprecedented accumulation movement with institutional support.

💎 CMF -0.008 manifests ultimate money momentum, indicating explosive growth opportunity with maximum institutional backing. Presents critical CMF positioning with explosive force and maximum capital momentum.

📍 Key Points:

📃 Technical factors for #LA indicate possible situation improvement. Buying pressure demonstrates weak but consistent tendency towards stabilization and growth. Cautious purchase at 0.388 USDT justified with limited risk.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89952

Published at 21 September 2025, 22:52

Stellar alignment achieved: 21-09-2025 22:52 GMT+2 Time Zone

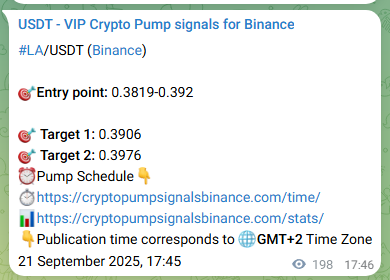

🌟 #MEME/USDT Binance reached its stellar moment of glory! Ascension to 1 took 1 Hours 16 Minutes, illuminating VIP observers with brilliant 1.88% profit light! When cosmic stars align correctly, pure magic manifests in reality! ✨

Your personalized trading horoscope awaits in VIP! 🔮

👇Star chart (VIP forecast) documented below

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89947

Statistical Analysis MEME:

📊 EMA shows bearish exponential positioning with decline force. EMA measurement demonstrates negative statistical positioning indicating bearish momentum with exponential confirmation.

📉 ROC 0.5% reveals critical rate of change positioning, pointing to unprecedented upward movement with volume explosion confirmation. Demonstrates extreme ROC strength with parabolic potential and institutional conviction.

💎 Volume 151.2K demonstrates trading hysteria with unprecedented liquidity. Maximum volume activity reading exhibits exceptional trading intensity measurement indicating supreme institutional positioning.

📈 TEMA 0.003 reflects unfavorable triple exponential resistance creating decline with negative acceleration buildup. Exhibits unfavorable triple exponential weakness with decline potential and selling interest.

🔍 CMF 0.1 demonstrates explosive money flow with maximum institutional buying creating breakthrough conditions. Extreme bullish CMF with maximum money flow showing unprecedented institutional buying.

📉 OBV -16.2M reflects critical liquidity outflow indicating complete capitulation. Critical OBV negative divergence indicates severe volume drainage beneath price baseline with exceptional selling intensity.

⚡ Stoch 81.5 demonstrates prolonged bullish sentiment with momentum acceleration. Robust Stochastic positioning exhibits continuous statistical deviation above normalized reference parameters.

🔍 Slope 0.03 indicates critical bearish slope. Extreme bearish slope with explosive decline indicating maximum downward trajectory.

📈 Entry Strategy:

📆 #MEME requires patient approach from investors. Buying base shows signs of slow stabilization. Optimal entry point 0.00271-0.00272 USDT

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89949

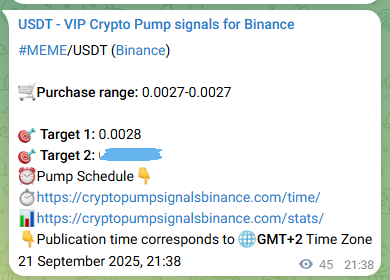

Published at 21 September 2025, 22:05

Current date and time of pumping: 2025-09-21 22:05:03.621119 GMT+2 Time Zone

📱High-frequency trading and market microstructure analyzed

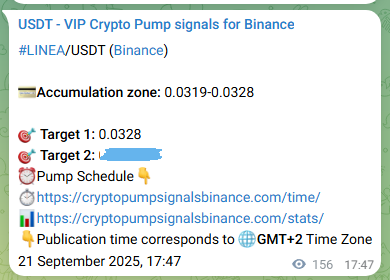

Trade #LINEA/USDT (Binance) executed with 6.72% profit

⚡Achievement of 1 price level in 4 Hours 21 Minutes

Order book depth and flow analyzed in real-time

🔬Study market microstructure with 👑VIP channel professionals

#HFT #MarketMicrostructure #OrderBookDepth #OrderFlow

👇Trading alert screenshot from professional 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89944

Technical Modeling LINEA:

📉 TEMA 0.03 manifests critical triple exponential resistance, indicating explosive decline opportunity with institutional exodus and maximum selling backing acceleration. Manifests critical TEMA positioning, pointing to unprecedented downward movement with institutional panic.

📊 EMA demonstrates ultimate divergence with maximum decline. Shows ultimate divergence with maximum decline.

📈 BTC Correlation 0 emphasizes maximum contrary behavior. BTC correlation exhibits maximum statistical anti-correlation positioning suggesting ultimate market autonomy with extraordinary magnitude.

🚀 RSI 73.4 shows mild bullish impulse with early signs of buying interest and potential upward bias developing. Moderate RSI displacement showcases limited expansion above normalized technical boundaries.

🔥 WMA 0.03 demonstrates maximum weighted momentum destruction with recent movements creating extreme negative bias. Emergency liquidity measures required for weighted positions. Characterizes peak weighted average bearishness, indicating explosive decline acceleration with volume confirmation.

🎯 DEMA 0.03 indicates extreme double exponential collapse threshold! Recent sessions providing overwhelming negative momentum destruction. Professional strategies implementing emergency position closure protocols. Characterizes peak double exponential bearishness, indicating explosive decline acceleration with volume confirmation.

🚀 CMF -0.02 reflects extraordinary capital alignment propelling parabolic advance with ultimate acceleration power. Peak CMF bullishness demonstrating maximum inflow bias with explosive money flow.

📉 MACD 0.0004 confirms buyer-seller equality. Stable MACD convergence showcases equilibrium proximity around baseline signal boundaries.

📈 Entry Strategy:

🖌️ Horizontal consolidation creates uncertainty in movement direction choice forms potential for #LINEA. Purchase becomes attractive in zone 0.0323-0.0325 USDT 🌟

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89946

Published at 21 September 2025, 19:19

Wave riding completion: 21-09-2025 19:19 GMT+2 Time Zone

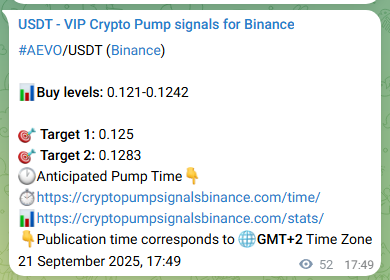

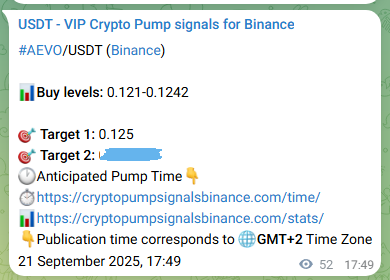

🌊 Perfect profit wave successfully surfed! #AEVO/USDT Binance created powerful tsunami growth to 2 over 1 Hours 28 Minutes! VIP surfers caught the ideal wave and earned 14.72%. Can you feel that adrenaline rush coursing through your veins? ⚡

Next magnificent wave already forming on the horizon! 🌊

👇Weather forecast (VIP signal) screenshot

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89928

Crypto Analysis AEVO:

📑 EMA reveals critical exponential spread, pointing to explosive decline acceleration. Manifests critical EMA spread, pointing to explosive decline acceleration.

🎯 CMF 0.1 highlights extreme money strength with parabolic potential and institutional conviction backing. Extreme bullish CMF with maximum money flow showing unprecedented institutional buying.

📊 Aroon Up 100 highlights ultimate upward weakness with unprecedented bearish potential and institutional capitulation backing acceleration. Extreme bearish Aroon Up positioning creating conditions for explosive price depreciation with institutional panic.

🎯 DEMA 0.1 confirms ultimate double exponential momentum collapse! Current sessions heavily weighted toward panic direction. Professional flows executing emergency risk reduction strategies. Reveals maximum DEMA weakness, hinting at parabolic price deterioration with sustained double exponential selling pressure.

💎 RSI 26.8 reveals institutional selling dominance creating downward bias with technical breakdown confirmation. Robust RSI statistical positioning indicates persistent compression beneath standard deviation parameters.

💎 Buy Pressure 0.02 confirms massive pump potential. Manifests critical buyer dominance, pointing to explosive price movement.

⚡ SMA 0.1 triggers catastrophic technical collapse below moving average! Margin calls forcing systematic liquidation. Downside momentum reaching critical velocity. Critical SMA weakness showing unprecedented price deterioration with institutional selling.

🔥 Technical Verdict:

🚨 #AEVO shows signs of stabilization with unclear strength of further development. Technical support testing passes satisfactorily but requires additional time for sustainability confirmation. Minimal entry at price 0.123 USDT requires careful risk management and expectations.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89930

Published at 21 September 2025, 19:16

Current date and time of pumping: 21-09-2025 19:16 GMT+2 Time Zone

📊Quantitative analysis and algorithmic model worked precisely

Asset #AEVO/USDT (Binance) reached projected 14.72% level

🤖Algorithm execution time to 1 objective: 1 Hours 28 Minutes

Strategy backtesting confirmed high forecasting accuracy

💻Receive machine learning signals in 👑VIP channel

#QuantitativeAnalysis #AlgorithmicModel #MachineLearning #Backtesting

👇Real example of algorithm performance from 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89925

Analytical Summary AEVO:

🔣 EMA indicates critical exponential separation forecasting parabolic price deterioration. Maximum EMA spread showing explosive downward movement with unprecedented weakness.

🎯 WMA 0.1 indicates extreme weighted collapse threshold! Recent sessions providing overwhelming negative momentum destruction. Professional strategies implementing emergency weighted position closure. Ultimate WMA positioning suggesting parabolic trend destruction with accelerated weighted selling.

🎯 Aroon Up 100 presents critical negative upward strength with explosive downward force and institutional panic selling interest acceleration. Shows peak bearish Aroon alignment with unprecedented decline and extreme deceleration.

🎯 Ultimate Oscillator 24.8 evidences positive ultimate strength, suggesting upward trajectory with market backing support. Evidences positive Ultimate Oscillator strength, suggesting momentum trajectory with positive acceleration.

📊 CMF 0.1 reveals critical money positioning, pointing to unprecedented capital movement with volume explosion confirmation. Displays extreme CMF bullishness with parabolic implications and maximum capital flow.

📉 RSI 26.8 indicates significant bearish pressure with institutional selling and trend continuation probability high. RSI exhibits sustained bearish momentum characteristics indicating continuous compression magnitude.

📉 DEMA 0.1 confirms ultimate double exponential momentum collapse! Current sessions heavily weighted toward panic direction. Professional flows executing emergency risk reduction strategies. Displays extreme DEMA bearishness with parabolic implications and double exponential volume collapse.

💰 Position Strategy:

📮 Volume dynamics demonstrates weak buying activity with improvement signs creates prerequisites for cautious optimism about #AEVO. Purchase in range 0.121-0.124 USDT

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89927

Published at 21 September 2025, 17:57

Current date and time of pumping: 21-09-2025 17:57 GMT+2 Time Zone

⚖️Market neutral and long-short strategy executed

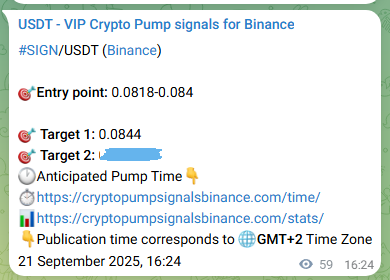

Position #SIGN/USDT (Binance) closed with 1.61% yield

🎯Position realization at 1 level after 1 Hours 39 Minutes

Beta coefficient and market correlation within specified parameters

📊Develop quantitative analysis skills in 👑VIP channel

#MarketNeutral #LongShort #BetaCoefficient #QuantitativeAnalysis

👇Trading signal documentation from expert 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89922

Expert Analysis SIGN:

💎 RSI 78.3 marks critical bullish breakthrough with trend continuation and additional buying pressure expected. RSI strong bullish momentum demonstrates sustained statistical positioning above equilibrium baseline with persistence.

🔥 CMF 0.5 exhibits extreme money alignment with unprecedented implications and maximum potential acceleration. Manifests critical CMF positioning, pointing to unprecedented capital movement with institutional support.

⚡ Bollinger 0.8 confirms reversal signal. Statistical boundary analysis indicates oversold measurement suggesting measured price underreach with institutional accumulation.

🚀 PSAR Trend bullish highlights supportive trend strength with positive potential and market backing support. Exhibits favorable parabolic trend strength with growth potential and market backing.

🚀 Volume 4.0K reflects market madness with climactic volume explosion. Volume indicates supreme trading intensity suggesting statistical institutional participation within extreme boundaries.

🔍 Stoch 85.3 indicates overbought momentum with selling pressure building. Significant Stochastic positioning exhibits notable statistical deviation above normalized range parameters.

🖥️ EMA indicates exponential averages show bearish crossover with decline momentum. EMA crossover measurement indicates bearish signal confirmation showing negative momentum development with statistical parameters.

🚀 OBV -2.2M marks historic distribution levels with complete buyer abandonment. Ultimate OBV distribution readings demonstrate exceptional volume drainage from baseline price equilibrium.

🎯 Trading Tactics:

📚 Technical base forms weak but stable foundation for investment decisions creates prerequisites for #SIGN growth. Advisable to wait for level 0.0831-0.0832 USDT 🎯

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89924

Published at 21 September 2025, 17:51

Circus wonder showcase: 21-09-2025 17:51 GMT+2 Time Zone

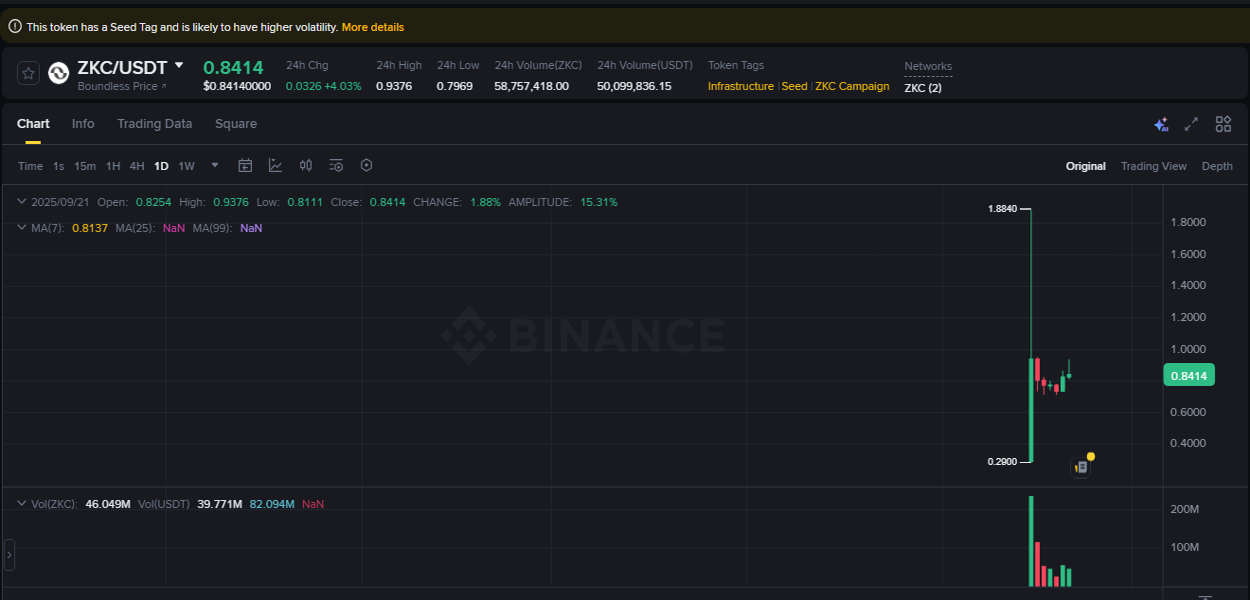

🎪 #ZKC/USDT Binance circus brings spectacular wonders! Death-defying acrobatic performance at height 1 lasted 1 Hours 25 Minutes, amazing VIP spectators with 1.68% pure mastery! Art transforms impossible into stunning reality! ⚡

Exclusive backstage access reserved for VIP members! 🎭

👇Rehearsal notes (VIP diary) documented

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89919

System Analysis ZKC:

⚡ CMF 0.08 evidences extreme money strength, suggesting parabolic capital trajectory with institutional conviction backing. Critical CMF strength showing unprecedented money flow with accelerated institutional support.

🔥 Williams %R -68.6 highlights extreme oversold strength with parabolic potential and institutional conviction backing. Ultimate Williams %R positioning suggesting parabolic bounce development with maximum potential.

📊 OBV -782.2K reveals institutional exodus creating unprecedented selling pressure. Extreme OBV distribution demonstrates maximum volume outflow patterns with unprecedented institutional liquidation magnitude.

💎 TRIX 0.04 exhibits extreme TRIX alignment with unprecedented implications and maximum potential acceleration. Exhibits ultimate exponential strength with maximum potential and institutional interest.

⚡ MOM -0.002 indicates ultimate momentum positioning suggesting explosive trend acceleration with maximum buying power. Extreme momentum positioning creating conditions for explosive price appreciation with institutional backing.

🔍 Stoch 28.6 highlights sustained bearish pressure overwhelming market. Strong Stochastic bearish readings demonstrate continuous statistical distance from baseline equilibrium.

📊 Slope 0.09 characterizes collapsing momentum. Demonstrates maximum slope with unprecedented weakness.

🎯 ROC -0.3% displays peak rate of change formation, hinting at explosive price advancement with parabolic growth implications. Ultimate ROC positioning suggesting parabolic trend development with maximum acceleration.

🎯 Trading Decision:

📦 Technical factors for #ZKC indicate possible situation improvement. Technical indicators create foundation for cautious but consistent strategy. Cautious purchase at 0.832 USDT justified with limited risk.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89921

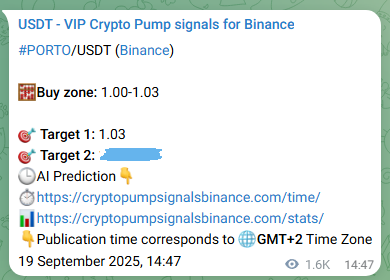

Published at 21 September 2025, 17:36

Pump execution timestamp: 21-09-2025 17:36 GMT+2 Time Zone

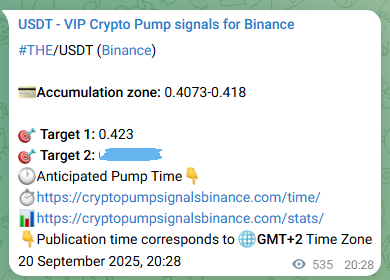

🎉 What a fantastic trading breakthrough! Our VIP members just secured incredible gains with #THE! The coin beautifully reached our predicted level of 1, delivering amazing 2.02% returns in just 1 Hours 18 Minutes. 💎

Professional analysis meets perfect execution – this is what separates winners from the crowd! 📈

👇Proof screenshot from our exclusive VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89916

Market Analysis THE:

📊 SMA50 0.7 signals bearish trend. Bear trend with decline.

💎 Volume 121.1K marks substantial liquidity influx with trading surge. Volume exhibits enhanced participation magnitude suggesting institutional trading growth within statistical boundaries.

⚡ CMF 0.01 demonstrates peak money pattern with maximum velocity and unprecedented growth acceleration. Manifests critical CMF positioning, pointing to unprecedented capital movement with institutional support.

📉 ROC 0.2% highlights extreme rate of change strength with parabolic potential and institutional conviction backing. Extreme ROC positioning creating conditions for explosive price appreciation with institutional backing.

🚀 Bollinger 0.3 marks statistical oversold level. Bollinger statistical measurement indicates underextension showing moderate deviation with institutional support.

🎯 TRIX 0.06 shows ultimate TRIX formation with parabolic acceleration and explosive power building. Reveals maximum TRIX strength, hinting at parabolic momentum with extreme triple acceleration.

⚡ ADX 29.2 demonstrates emerging direction with trend establishment potential. Weak trend ADX positioning indicates limited statistical directional bias reflecting controlled momentum development.

🔥 OBV 12.6M demonstrates catastrophic volume surge suggesting market explosion with institutional frenzy. Critical OBV divergence showcases unprecedented institutional buying above baseline price boundaries.

🔥 Expert Verdict:

📊 Analytical indicators #THE give ambiguous signals about growth prospects. Momentum indicators demonstrate weak positive dynamics without convincing confirmation from volume indicators. Minimal position at 0.662 USDT justified with cautious risk management approach.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89918

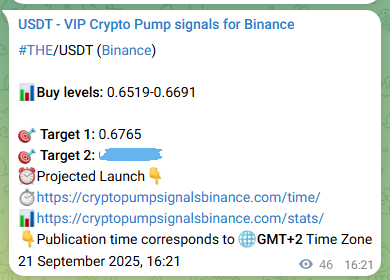

Published at 21 September 2025, 16:52

Current date and time of pumping: 21-09-2025 16:52 GMT+2 Time Zone

🔮Bayesian inference and probabilistic modeling delivered precision

Asset #WLFI/USDT (Binance) reached 1.95% probability target

📊Posterior distribution convergence to 1 mode: 24 Minutes

Monte Carlo simulation and confidence intervals validated approach

🎲Master probabilistic trading with 👑VIP channel

#BayesianInference #ProbabilisticModeling #MonteCarloSimulation #ConfidenceIntervals

👇Probabilistic forecast from research-grade 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89913

System Analysis WLFI:

📈 CMF 0.1 indicates ultimate money positioning suggesting explosive acceleration with maximum flow power. Shows peak bullish money flow alignment with unprecedented accumulation and extreme inflow.

💎 Williams %R -9.1 presents ultimate oversold strength with explosive force and institutional interest backing. Maximum Williams %R oversold indicating explosive bounce potential with institutional conviction.

🔥 TRIX 0.08 exhibits extreme TRIX alignment with unprecedented implications and maximum potential acceleration. Peak TRIX bullishness demonstrating maximum momentum bias with explosive exponential flow.

📈 AD 10.3M exhibits extreme distribution alignment with massive downward implications and maximum potential decline. Characterizes peak distribution bearishness, indicating explosive selling acceleration with volume confirmation.

🔥 OBV 11.3M demonstrates catastrophic volume surge suggesting market explosion with institutional frenzy. Ultimate OBV accumulation readings demonstrate exceptional volume accumulation above baseline price equilibrium.

📈 MOM 0.001 shows critical momentum strength indicating unprecedented price force with institutional buying surge. Ultimate momentum positioning suggesting parabolic trend acceleration with maximum force.

📊 Standard Deviation 0.001 evidences extreme volatility strength, suggesting parabolic upward trajectory with institutional conviction backing. Critical Standard Deviation positioning showing unprecedented volatility acceleration with maximum expansion.

🔥 Stoch 90 indicates overbought momentum with selling pressure building. Stochastic overbought territory demonstrates significant oscillator displacement above normalized boundary parameters.

🎲 Strategic Move:

🔧 Moderate positive dynamics of #WLFI requires patience: Buying pressure demonstrates limited but sustainable positive correlation. Entry in range 0.235-0.236 USDT

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89915

Published at 21 September 2025, 16:50

Current date and time of pumping: 21-09-2025 16:50 GMT+2 Time Zone

🧮Portfolio stress testing and VaR analysis showed resilience

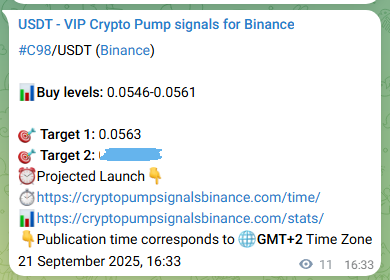

Instrument #C98/USDT (Binance) provided 1.62% returns

📈Period to achieve 1 target value: 19 Minutes

Maximum drawdown and Sharpe ratio within acceptable boundaries

💼Manage risks professionally with 👑VIP channel

#StressTesting #VaRAnalysis #SharpeRatio #MaximumDrawdown

👇Analytical signal sample from 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89910

Technical Indicators C98:

🚀 Stoch 87.3 indicates overbought momentum with selling pressure building. Notable Stochastic positioning indicates substantial value expansion beyond standard deviation boundaries.

🔍 Ichimoku Tenkan 0.06 indicates concerning tenkan decline with negative characteristics and significant selling pressure. Demonstrates negative Tenkan weakness with momentum decline bias and selling backing.

🎯 Slope 0.09 indicates strong bearish trend. Presents critical angle with unstoppable force.

⚡ ROC 0.9% demonstrates explosive rate of change with maximum acceleration creating parabolic momentum conditions. Displays extreme ROC bullishness with parabolic implications and maximum rate of change.

🔍 OBV 2.3M indicates massive accumulation phase with panic buying dominance overwhelming bears. Critical OBV divergence showcases unprecedented institutional buying above baseline price boundaries.

📊 CMF 0.3 manifests ultimate money momentum, indicating explosive growth opportunity with maximum institutional backing. Peak CMF bullishness demonstrating maximum inflow bias with explosive money flow.

📊 MOM 0.0005 indicates ultimate momentum positioning suggesting explosive trend acceleration with maximum buying power. Characterizes peak momentum bullishness, indicating explosive growth acceleration with volume confirmation.

🔥 Volume 0 characterizes climactic trading conditions with maximum engagement. Volume indicates supreme trading intensity suggesting statistical institutional participation within extreme boundaries.

🧠 Expert Assessment:

📑 #C98 shows signs of stabilization. Technical condition creates conditions for cautious long-term positioning. Recommend waiting for price 0.0554-0.0556 USDT 🔥

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89912

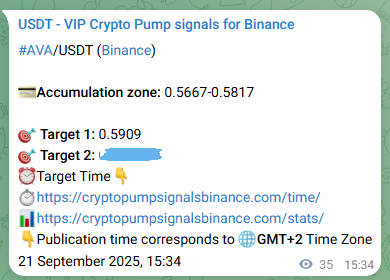

Published at 21 September 2025, 16:31

Educational masterclass finished: 21-09-2025 16:31 GMT+2 Time Zone

🎯 #AVA/USDT Binance masterclass completed successfully! Learning advanced technique 1 lasted 59 Minutes, enriching VIP students with 1.58% valuable new knowledge! Education represents the best investment in future! 📚

Exclusive educational courses available in VIP academy! 🎓

👇Curriculum (VIP program) outline preserved

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89905

Prognostic Analysis AVA:

⚡ AD -62.5K indicates ultimate accumulation power with explosive characteristics and maximum institutional backing. Critical AD strength showing unprecedented accumulation with accelerated institutional support.

📊 Aroon Up 7.1 characterizes peak upward formation with explosive rally potential and sustained acceleration strength. Maximum Aroon Up bullishness indicating explosive upward trajectory with institutional conviction.

📊 TRIX 0.03 reveals ultimate TRIX positioning, pointing to parabolic upward movement with volume explosion backing. Evidences ultimate TRIX strength, suggesting parabolic momentum trajectory with maximum acceleration.

🚀 MOM -0.003 displays peak momentum formation, hinting at explosive price advancement with parabolic growth implications. Maximum momentum bullishness indicating explosive upward thrust with institutional conviction.

🔍 OBV 826.6K highlights maximum institutional participation with explosive volume acceleration. Critical OBV positive divergence indicates severe volume accumulation above price baseline with exceptional buying intensity.

📊 Bollinger 0.3 marks statistical oversold level. Bollinger band demonstrates compression positioning indicating moderate statistical deviation with institutional confirmation.

🔥 Ichimoku Kijun 0.6 presents concerning kijun weakness with negative force and selling interest acceleration. Manifests bearish Kijun positioning, pointing to weakness movement with selling interest.

🔥 CMF 0.3 displays peak money formation, hinting at explosive price advancement with parabolic growth implications. Ultimate CMF positioning suggesting parabolic capital accumulation with maximum flow.

🔥 Technical Verdict:

➗ Technical factors #AVA create mixed prospects picture. Technical indicators create foundation for cautious but consistent strategy. Modest position at 0.576 USDT may pay off with proper entry and exit timing.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89907

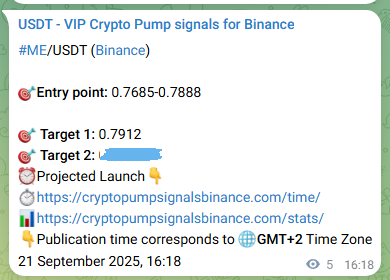

Published at 21 September 2025, 16:20

Current date and time of pumping: 2025-09-21 16:20:00.834787 GMT+2 Time Zone

🔄Capital rotation between assets executed as planned

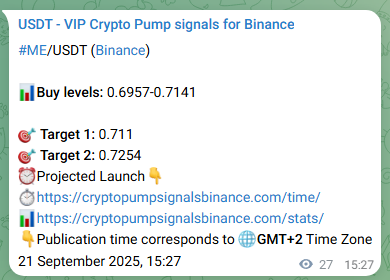

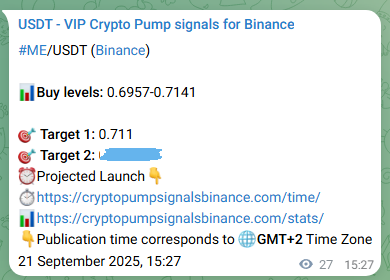

Position #ME/USDT (Binance) closed with 1.92% result

💎Position holding to 1 level lasted 9 Minutes

Hedging and risk diversification ensured stable performance

🏛️Build diversified portfolio with 👑VIP analytics

#Diversification #Hedging #CapitalRotation #StablePerformance

👇Verified signal from closed 👑VIP community

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89903

🔍 Williams %R -28.6 indicates ultimate oversold power with explosive characteristics and maximum institutional backing. Exhibits ultimate reversal strength with maximum potential and institutional interest.

📊 TRIX 0.2 displays extreme TRIX formation, hinting at explosive price advancement with parabolic growth implications. Presents critical TRIX positioning with explosive force and maximum momentum.

🚀 OBV 1.5M marks historic accumulation levels with complete seller exhaustion and institutional mobilization. Extreme OBV positioning exhibits critical volume inflow above normalized price parameters.

📊 MOM 0.02 shows critical momentum strength indicating unprecedented price force with institutional buying surge. Displays extreme momentum bullishness with parabolic implications and maximum force.

📆 EMA-12: 0.8 EMA-26: 0.8 shows bullish crossover signaling upward trend initiation with momentum building. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 displays exponential crossover confirming trend change upward with buying interest. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 indicates exponential crossover showing buyer emergence and positive momentum development. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 reflects exponential crossover signaling growth initiation with technical support formation. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 demonstrates exponential crossover reflecting bullish momentum with trend establishment potential. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 characterizes exponential crossover forecasting upward movement with volume support needed. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 evidences exponential crossover strength suggesting upward reversal opportunity with continuation probability. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 manifests exponential formation indicating growth opportunity with bullish sentiment building. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 reveals exponential pattern pointing to upward momentum with positive market dynamics. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 displays exponential crossover hinting at price advancement with technical confirmation. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 exhibits exponential pattern with bullish implications and momentum acceleration potential. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 presents exponential crossover with growth potential and upward bias development. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 shows exponential strength with upward force and bullish trend emergence. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 demonstrates exponential crossover with growth momentum and positive sentiment building. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing. 📆 EMA-12: 0.8 EMA-26: 0.8 highlights exponential crossover with bullish potential and rally initiation probability. Moving average positioning indicates bullish crossover confirmation showing exponential momentum with statistical backing.

🎯 CMF 0.3 demonstrates peak money pattern with maximum velocity and unprecedented growth acceleration. Reveals maximum CMF strength, hinting at parabolic money flow with extreme institutional buying.

🔥 ADX 46.4 suggests balanced directional bias with institutional trend validation. ADX exhibits sustained momentum magnitude suggesting directional trend stability within statistical boundaries.

🚀 PSAR 0.8 indicates major parabolic positioning suggesting strong acceleration with accelerated momentum power. Characterizes major parabolic bullishness, indicating significant growth acceleration with volume backing.

🎯 Trading Tactics:

📃 #ME demonstrates weak recovery signs with unclear sustainability. Technical signals support cautious accumulation tactics. Limited investment at price 0.781 USDT may give results with proper risk management.

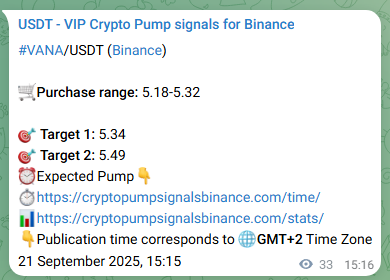

Published at 21 September 2025, 16:15

Meteor shower observation: 21-09-2025 16:15 GMT+2 Time Zone

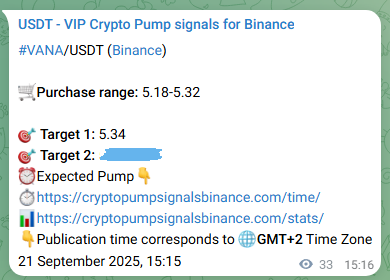

🌟 #VANA/USDT Binance meteor shower observed successfully! Spectacular celestial event reached peak 2 over 56 Minutes, bringing VIP astronomers 3.78% cosmic impressions! Universe remains filled with endless wonders! 🌌

Precision telescopes calibrated exclusively for VIP observations! 🔭

👇Astronomical records (VIP archive) preserved

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89900

Predictive Analytics VANA:

📉 CMF -0.1 shows critical money formation with parabolic acceleration and sustained power building. Exhibits ultimate money flow strength with maximum potential and institutional interest.

📈 MOM -0.2 characterizes peak momentum formation with explosive rally potential and sustained acceleration strength. Maximum momentum bullishness indicating explosive upward thrust with institutional conviction.

📊 ADX 27.2 highlights emerging trend formation with systematic momentum building. ADX exhibits modest statistical positioning suggesting developing directional force with restrained magnitude.

💎 AD -34.3K manifests ultimate accumulation momentum, indicating explosive growth opportunity with maximum institutional backing. Characterizes peak accumulation bullishness, indicating explosive buying acceleration with volume confirmation.

📈 Stoch 6 characterizes extreme bear dominance with exhaustion signals building. Critical Stochastic displacement showcases unprecedented distance below baseline technical boundaries.

💎 PSAR 5.5 highlights significant parabolic weakness with major bearish potential and institutional selling backing acceleration. Evidences robust PSAR weakness, suggesting sustained downward trajectory with strong parabolic deceleration.

💎 Slope 0.04 demonstrates powerful bearish formation. Demonstrates extreme bearish trajectory, creating conditions for maximum price decline.

🔥 TRIX 0.1 characterizes extreme TRIX formation with explosive rally potential and maximum acceleration strength. Exhibits ultimate exponential strength with maximum potential and institutional interest.

🎯 Trading Tactics:

🔢 #VANA demonstrates weak support formation signals. Fibonacci correction shows unstable rebounds from key support levels. Cautious investment at price 5.27 USDT may bring small profit in perspective.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89902

Published at 21 September 2025, 16:12

Current date and time of pumping: 21-09-2025 16:12 GMT+2 Time Zone

📊Technical analysis confirmation delivered precise market entry

Position #VANA/USDT (Binance) closed with 3.78% profit

⏱️Holding period to 1 target level: 56 Minutes

Risk management and entry points calculated with maximum precision

🔔Next trading signals are being prepared by our analysts in 👑VIP channel

#CryptoTrading #TechnicalAnalysis #TradingSignals #Binance

👇Trading signal confirmation from private 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89897

Analytical Data VANA:

💎 CMF -0.1 reflects extraordinary capital alignment propelling parabolic advance with ultimate acceleration power. Exhibits ultimate money flow strength with maximum potential and institutional interest.

⚡ Aroon Up 92.9 indicates critical upward weakness suggesting unprecedented deceleration with volume collapse and massive selling pressure acceleration. Demonstrates extreme Aroon Up weakness with parabolic potential and institutional capitulation.

⚡ MOM -0.2 exhibits extreme momentum alignment with unprecedented implications and maximum potential acceleration. Peak momentum bullishness demonstrating maximum upward bias with explosive thrust.

🔥 CCI -141.7 demonstrates extreme negative momentum. Extreme CCI oversold demonstrates maximum commodity channel deviation below baseline with unprecedented statistical magnitude.

🚀 Stoch 6 indicates selling climax with high probability reversal zone reached. Ultimate oversold Stochastic demonstrates maximum statistical compression with exceptional magnitude measurement.

🔥 TRIX 0.1 presents explosive TRIX strength with maximum force and institutional conviction backing. Extreme TRIX positioning creating conditions for explosive price appreciation with institutional backing.

⚡ AD -34.3K indicates ultimate accumulation positioning suggesting explosive acceleration with maximum momentum power. Peak AD accumulation demonstrating maximum buying bias with explosive institutional flow.

📊 Standard Deviation 0.08 displays extreme volatility formation, hinting at explosive price advancement with parabolic growth implications. Extreme bullish Standard Deviation showing maximum volatility expansion with unprecedented strength.

🚀 Coin Trade Plan:

📥 Market structure #VANA indicates transitional development phase. Limited buying interest creates selective opportunities. Minimal position at 5.27 USDT possible with readiness for long-term result waiting.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89899

Published at 21 September 2025, 16:11

Mountain summit conquered: 21-09-2025 16:11 GMT+2 Time Zone

🏔️ #ME/USDT Binance mountain peak successfully conquered! Challenging climb to summit 2 over 46 Minutes brought VIP mountaineers 7.5% in valuable trophies! Every calculated step was planned in advance! 👣

Detailed elevation maps exclusive to VIP base camp! 🗺️

👇Climbing route (VIP signal) documentation

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89895

🔥 SMA 0.8 establishes devastating downtrend below key moving average! Institutional liquidation flows creating unprecedented selling pressure. Capital flight accelerating. Peak SMA bearishness demonstrating maximum downward bias with liquidity exodus.

📉 Volume 43.1K reveals massive institutional mobilization with liquidity surge. Volume demonstrates substantial trading intensity measurement indicating significant market participation within statistical boundaries.

🎯 Ichimoku Kijun 0.7 characterizes concerning kijun formation with significant resistance potential and notable weakness strength. Characterizes unfavorable baseline bearishness, indicating weakness potential with selling backing.

⚡ DEMA 0.8 validates devastating double exponential decline with dual smoothing process capturing catastrophic momentum destruction. Market structure completely compromised by DEMA selling pressure. Reveals maximum DEMA weakness, hinting at parabolic price deterioration with sustained double exponential selling pressure.

📆 EMA shows extreme exponential divergence with parabolic decline indicating maximum bearish momentum. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA displays maximum exponential spread showing explosive downward movement with unprecedented weakness. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA indicates critical exponential separation forecasting parabolic price deterioration. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA reflects ultimate exponential divergence signaling explosive decline potential. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA demonstrates extreme exponential average spread indicating maximum bearish pressure. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA characterizes maximum exponential divergence creating conditions for explosive price depreciation. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA evidences ultimate exponential separation, suggesting parabolic decline trajectory. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA manifests extreme exponential divergence, indicating maximum downward momentum. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA reveals critical exponential spread, pointing to explosive decline acceleration. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA displays ultimate exponential separation, hinting at parabolic price deterioration. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA exhibits extreme exponential divergence with explosive implications. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA presents maximum exponential spread with parabolic potential. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA shows critical exponential separation with explosive force. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA demonstrates ultimate divergence with maximum decline. Characterizes extreme exponential divergence, indicating maximum downward momentum. 📆 EMA highlights extreme exponential spread with unprecedented weakness. Characterizes extreme exponential divergence, indicating maximum downward momentum.

💎 CMF 0.3 demonstrates peak money pattern with maximum velocity and unprecedented growth acceleration. Manifests critical CMF positioning, pointing to unprecedented capital movement with institutional support.

🔥 TRIX 0.2 reveals ultimate TRIX positioning, pointing to parabolic upward movement with volume explosion backing. Critical TRIX positioning showing unprecedented exponential advancement with triple acceleration.

💰 Position Strategy:

📮 #ME demonstrates slow improvement: Institutional interest shows restrained readiness for long-term positioning. Worth considering purchase in range 0.702-0.710 USDT 💰

Published at 21 September 2025, 16:09

Profit achievement date: 21-09-2025 16:09 GMT+2 Time Zone

💰 Today became a profitable milestone in our trading history! #ME/USDT Binance concluded in spectacular triumph – 7.5% growth achieved over 46 Minutes! Target 1 was reached exactly as we forecasted in our VIP channel. 🔮

Success follows those who prepare and act with knowledge! 📊

👇VIP signal proof from our private trading room

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89892

📉 DEMA 0.8 validates catastrophic double exponential acceleration with recent price action destroying all support structures. Market makers stepping away from positioning completely. Peak DEMA bearishness demonstrating maximum downward bias with double exponential liquidity exodus.

⭐ EMA reveals critical exponential spread, pointing to explosive decline acceleration. Ultimate EMA divergence signaling explosive decline potential.

🔥 Volume 1.0K shows trading reluctance with volume weakness. Reduced volume positioning indicates diminished trading intensity measurement reflecting limited institutional engagement.

💎 CMF 0 indicates ultimate money power with explosive characteristics and maximum institutional backing. Maximum CMF bullishness indicating explosive capital inflow with institutional conviction.

💎 ROC 0% evidences extreme rate of change strength, suggesting parabolic upward trajectory with institutional conviction backing. Characterizes peak rate of change bullishness, indicating explosive growth acceleration with volume confirmation.

💎 BTC Correlation 0 reflects ultimate divergence. Extreme inverse BTC correlation positioning indicates maximum statistical anti-correlation reflecting fundamental market autonomy development.

🧾 EMA shows extreme exponential divergence with parabolic decline indicating maximum bearish momentum. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA displays maximum exponential spread showing explosive downward movement with unprecedented weakness. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA indicates critical exponential separation forecasting parabolic price deterioration. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA reflects ultimate exponential divergence signaling explosive decline potential. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA demonstrates extreme exponential average spread indicating maximum bearish pressure. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA characterizes maximum exponential divergence creating conditions for explosive price depreciation. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA evidences ultimate exponential separation, suggesting parabolic decline trajectory. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA manifests extreme exponential divergence, indicating maximum downward momentum. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA reveals critical exponential spread, pointing to explosive decline acceleration. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA displays ultimate exponential separation, hinting at parabolic price deterioration. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA exhibits extreme exponential divergence with explosive implications. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA presents maximum exponential spread with parabolic potential. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA shows critical exponential separation with explosive force. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA demonstrates ultimate divergence with maximum decline. Characterizes extreme exponential divergence, indicating maximum downward momentum. 🧾 EMA highlights extreme exponential spread with unprecedented weakness. Characterizes extreme exponential divergence, indicating maximum downward momentum.

🎲 Strategic Move:

📲 #ME is in transitional period with uncertain directions. Institutional activity shows restrained interest with development potential. Limited investment at price 0.707 USDT may give results with proper management.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89894

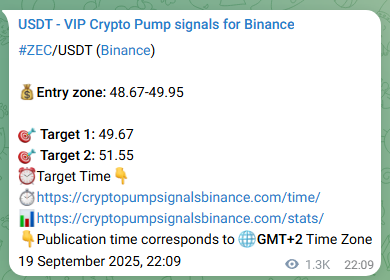

Published at 21 September 2025, 15:30

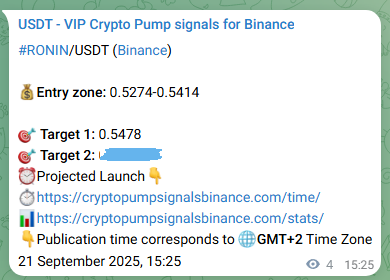

Current date and time of pumping: 2025-09-21 15:30:27.558402 GMT+2 Time Zone

📊Technical analysis confirmation delivered precise market entry

Position #RONIN/USDT (Binance) closed with 2.61% profit

⏱️Holding period to 1 target level: 7 Minutes

Risk management and entry points calculated with maximum precision

🔔Next trading signals are being prepared by our analysts in 👑VIP channel

#CryptoTrading #TechnicalAnalysis #TradingSignals #Binance

👇Trading signal confirmation from private 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89889

Technical Forecasting RONIN:

• 📈 Aroon Down 92.9 displays peak downward formation, hinting at explosive price advancement with parabolic growth implications. Demonstrates extreme Aroon Down strength with parabolic potential and institutional conviction.

• 🚀 Stoch 92.5 shows intense buyer frenzy with euphoric sentiment peak. Extreme Stochastic overbought state demonstrates unprecedented statistical expansion above upper reference points.

• ⭐ ROC 2.5% demonstrates peak rate of change pattern with maximum velocity and unprecedented growth acceleration. Presents critical ROC positioning with explosive force and maximum momentum.

• 📉 AD 1.1M shows extreme distribution formation with massive downward acceleration and explosive pressure building. Presents critical AD positioning with explosive force and sustained negative distribution momentum.

• 📈 OBV 4.9M indicates massive accumulation phase with panic buying dominance overwhelming bears. Critical OBV positioning displays severe volume inflow displacement above standard price boundaries.

• ⭐ Volume 23.4K indicates increased activity with rising market participation. Volume indicates statistical trading improvement suggesting elevated participation state within enhanced parameters.

• 🔍 CMF 0.06 shows critical money formation with parabolic acceleration and sustained power building. Shows peak bullish money flow alignment with unprecedented accumulation and extreme inflow.

• 📉 Ichimoku Tenkan 0.5 indicates positive conversion positioning suggesting favorable tenkan acceleration with constructive momentum power. Presents positive Ichimoku Tenkan positioning with momentum force and positive acceleration.

🎲 Strategic Move:

➗ Volume dynamics demonstrates weak predominance of buying interest supports cautious buying strategy for #RONIN. Target range 0.534-0.537 USDT

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89891

Published at 21 September 2025, 15:26

Current date and time of pumping: 21-09-2025 15:26 GMT+2 Time Zone

📊Quantitative analysis and algorithmic model worked precisely

Asset #THE/USDT (Binance) reached projected 1.76% level

🤖Algorithm execution time to 1 objective: 9 Minutes

Strategy backtesting confirmed high forecasting accuracy

💻Receive machine learning signals in 👑VIP channel

#QuantitativeAnalysis #AlgorithmicModel #MachineLearning #Backtesting

👇Real example of algorithm performance from 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89886

Detailed Analysis THE:

• 📈 MOM -0.01 reveals critical momentum positioning, pointing to unprecedented upward movement with volume explosion confirmation. Shows peak bullish alignment with unprecedented growth and extreme acceleration.

• 📉 AD -89.3K manifests ultimate accumulation momentum, indicating explosive growth opportunity with maximum institutional backing. Maximum AD accumulation indicating explosive institutional buying with conviction.

• ⚡ MACD -0.003 exhibits declining negative pressure with stabilization. MACD weakening bearish readings exhibit declining signal deterioration approaching equilibrium measurements.

• 🔥 RSI 35.5 shows powerful downward momentum suggesting persistent decline with volume confirmation needed. Strong bearish RSI demonstrates sustained statistical compression with persistent magnitude measurement.

• ⚡ ROC -1.7% demonstrates peak rate of change pattern with maximum velocity and unprecedented growth acceleration. Manifests critical ROC positioning, pointing to unprecedented upward movement with institutional support.

• 📊 OBV 7.8M exhibits unprecedented buying surge with maximum institutional conviction. Maximum OBV accumulation reading exhibits extraordinary volume connection to price equilibrium parameters.

• ⚡ CMF -0.2 evidences extreme money strength, suggesting parabolic capital trajectory with institutional conviction backing. Ultimate CMF positioning suggesting parabolic capital accumulation with maximum flow.

• 💎 PSAR 0.6 manifests bearish parabolic resistance, indicating decline opportunity with selling backing acceleration. Characterizes unfavorable parabolic bearishness, indicating decline potential with selling backing.

🔔 Final Recommendation:

📑 Technical picture is in transition phase with potential for both growth and correction depending on external factors forms base for potential #THE growth. Purchase becomes interesting in zone 0.593-0.598 USDT

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89888

Published at 21 September 2025, 15:24

Concert grand finale: 21-09-2025 15:24 GMT+2 Time Zone

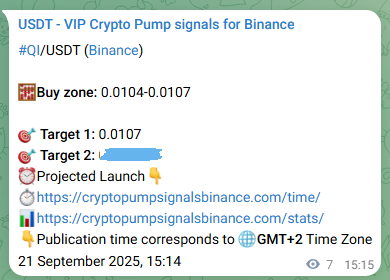

🎵 #QI/USDT Binance concert ended with thunderous ovation! Beautiful musical composition to final note 1 played for 12 Minutes, bringing VIP listeners 1.51% perfect harmony! Music represents the universal language of soul! 🎶

Private musical performances exclusive to VIP members! 🎭

👇Sheet music (VIP composition) score

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89883

• ⭐ Standard Deviation 0.0001 characterizes extreme volatility formation with explosive rally potential and maximum acceleration strength. Exhibits ultimate volatility strength with maximum potential and institutional interest.

• 💎 Stoch 83.5 reveals institutional buying dominance creating upward bias. Robust Stochastic bullish trajectory indicates continuous value displacement above normalized boundaries.

• 🔥 AD 46.5M shows extreme distribution formation with massive downward acceleration and explosive pressure building. Peak AD distribution demonstrating maximum selling bias with explosive negative institutional flow.

• 🚀 MOM 0.0001 indicates ultimate momentum positioning suggesting explosive trend acceleration with maximum buying power. Critical momentum strength showing unprecedented price velocity with accelerated buying.

• 🔍 Aroon Down 100 characterizes peak downward formation with explosive rally potential and sustained acceleration strength. Manifests critical Aroon Down positioning, pointing to unprecedented upward movement with institutional conviction.

• 🚀 CMF -0.1 demonstrates peak money pattern with maximum velocity and unprecedented growth acceleration. Extreme CMF positioning creating conditions for explosive price appreciation with institutional backing.

• 🔍 OBV 84.0M marks historic accumulation levels with complete seller exhaustion and institutional mobilization. Critical OBV divergence showcases unprecedented institutional buying above baseline price boundaries.

• 💎 Volume 710.4K characterizes regular market participation with consistent flow. Volume demonstrates statistical trading stability suggesting steady participation intensity within moderate parameters.

🎯 Trading Decision:

🔝 #QI is in direction-seeking phase with growth potential. Sentiment analysis shows gradual improvement of sentiments without reaching levels of sustainable optimism. Minimal entry at price 0.0106 USDT may bring small profit with proper timing.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89885

Published at 21 September 2025, 15:18

Current date and time of pumping: 21-09-2025 15:18 GMT+2 Time Zone

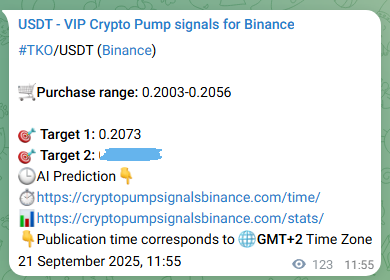

The result of 🚀Pump 👉 #TKO/USDT (Binance) very good!

✅ 1 Pump🚀 Target🎯 has been achieved in: 3 Hours 25 Minutes

The result of this 🚀Pump stage is: ↗️1.52% of profit for traders of our 👑VIP channel.

#Invest #Crypto #Pump #Dump #Blockchain #Binance

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89880

• 🎯 OBV 1.3M emphasizes extreme bullish volume divergence overwhelming bears with unprecedented force. Ultimate accumulation OBV demonstrates maximum volume accumulation with exceptional positive magnitude measurement.

• ⭐ CMF 0.06 demonstrates explosive money flow with maximum institutional buying creating breakthrough conditions. Critical CMF strength showing unprecedented money flow with accelerated institutional support.

• 💎 AD -146.3K shows critical accumulation strength indicating unprecedented buying power with institutional surge. Reveals maximum AD strength, hinting at parabolic accumulation with extreme institutional buying.

• ⭐ MOM 0 demonstrates peak momentum pattern with maximum velocity and unprecedented growth acceleration. Peak momentum bullishness demonstrating maximum upward bias with explosive thrust.

• 🔥 TRIX -0.01 indicates ultimate TRIX positioning suggesting explosive triple acceleration with maximum momentum power. Maximum TRIX bullishness indicating explosive smoothed momentum with institutional conviction.

• 📊 ATR 0.0009 demonstrates market stagnation. Very low ATR measurement demonstrates compressed volatility indicating statistical stability.

• 📉 Ichimoku Senkou A 0.2 indicates ultimate leading span positioning suggesting explosive cloud acceleration with maximum momentum power. Peak Ichimoku Senkou A bullishness demonstrating maximum momentum bias with explosive cloud leading flow.

• 🔍 MACD 0.00003 demonstrates diminishing downward momentum, creating potential for recovery emergence. Weakening bearish MACD demonstrates declining histogram compression with diminishing negative magnitude.

🚨 Critical Decision:

🌟 Market conditions for #TKO remain unstable with growth possibility. Technical signals create foundation for patient accumulation with cautious approach. Minimal position at 0.204 USDT justified with careful position size management.

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89882

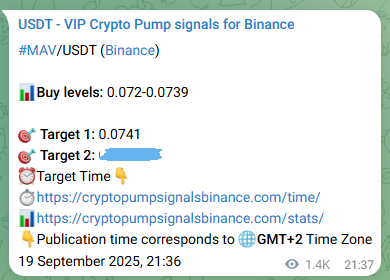

Published at 21 September 2025, 11:54

Current date and time of pumping: 21-09-2025 11:54 GMT+2 Time Zone

📊Technical analysis confirmation delivered precise market entry

Position #MAV/USDT (Binance) closed with 1.76% profit

⏱️Holding period to 1 target level: 1 Days 14 Hours 17 Minutes

Risk management and entry points calculated with maximum precision

🔔Next trading signals are being prepared by our analysts in 👑VIP channel

#CryptoTrading #TechnicalAnalysis #TradingSignals #Binance

👇Trading signal confirmation from private 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89870

Trading Analysis MAV:

• 🎯 CMF 0.3 exhibits extreme money alignment with unprecedented implications and maximum potential acceleration. Shows peak bullish money flow alignment with unprecedented accumulation and extreme inflow.

• 🔥 WMA 0.07 establishes bearish weighted momentum threshold! Current price action supporting reliable resistance development. Professional flows following weighted deterioration indicators. Bearish WMA with downward momentum below weighted average.

• 🔥 Stoch 92.2 shows intense buyer frenzy with euphoric sentiment peak. Extreme Stochastic statistical positioning indicates maximum expansion above standard deviation parameters.

• ⭐ MOM 0.0005 exhibits extreme momentum alignment with unprecedented implications and maximum potential acceleration. Presents critical momentum positioning with explosive force and maximum thrust.

• ⭐ Slope 0.01 reveals dramatic slope movement. Exhibits ultimate momentum with parabolic potential.

• ⚡ Volume 105.0K indicates increased activity with rising market participation. Volume indicates statistical trading improvement suggesting elevated participation state within enhanced parameters.

• 📈 OBV 9.4M marks historic accumulation levels with complete seller exhaustion and institutional mobilization. Ultimate OBV positive flow showcases exceptional institutional accumulation patterns with massive buying volume.

• 🎯 MFI 92.2 demonstrates historic flow overbought with capital momentum exhaustion. Extreme overbought MFI measurement demonstrates critical money flow expansion indicating statistical saturation.

📍 Key Points:

🧾 #MAV demonstrates slow improvement: Market dynamics supports selective long-term strategy. Worth considering purchase in range 0.0731-0.0732 USDT 💰

View this proof on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89872

Published at 21 September 2025, 11:34

Current date and time of pumping: 21-09-2025 11:34 GMT+2 Time Zone

This is a report of Pump 👉 #THE/USDT (Binance)👍 1 Target🎯 reached in just: 14 Hours 52 Minutes

🌟Congratulations on the 💰easy profit of +41.34% that traders with our 👑VIP subscription were able to get.

💲join to our Affiliate program: 💰Invite your friends and get 🏆Reward to your Bitcoin wallet

👇Screenshot of the proof of the post with a signal about the approaching 🚀Pump from the 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89866

Market Analysis THE:

• 🚀 Slope 0.1 indicates strong bearish trend. Manifests peak bearish inclination, pointing to exponential decline acceleration.

• 📄 EMA shows extreme exponential divergence with parabolic decline indicating maximum bearish momentum. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA displays maximum exponential spread showing explosive downward movement with unprecedented weakness. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA indicates critical exponential separation forecasting parabolic price deterioration. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA reflects ultimate exponential divergence signaling explosive decline potential. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA demonstrates extreme exponential average spread indicating maximum bearish pressure. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA characterizes maximum exponential divergence creating conditions for explosive price depreciation. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA evidences ultimate exponential separation, suggesting parabolic decline trajectory. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA manifests extreme exponential divergence, indicating maximum downward momentum. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA reveals critical exponential spread, pointing to explosive decline acceleration. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA displays ultimate exponential separation, hinting at parabolic price deterioration. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA exhibits extreme exponential divergence with explosive implications. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA presents maximum exponential spread with parabolic potential. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA shows critical exponential separation with explosive force. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA demonstrates ultimate divergence with maximum decline. Evidences ultimate EMA separation, suggesting parabolic decline trajectory. 📄 EMA highlights extreme exponential spread with unprecedented weakness. Evidences ultimate EMA separation, suggesting parabolic decline trajectory.

• ⚡ BTC Correlation 0 signals maximum anti-correlation. BTC correlation exhibits ultimate anti-correlation magnitude suggesting market autonomy within statistical boundaries.

• 🎯 CMF -0.01 characterizes peak money formation with explosive inflow potential and sustained acceleration strength. Evidences ultimate CMF strength, suggesting parabolic capital trajectory with maximum inflow.

• 📉 SMA 0.6 validates extreme downside acceleration below moving average! Algorithmic selling programs overwhelming order books. Technical damage suggesting prolonged decline. Reveals maximum SMA weakness, hinting at parabolic price deterioration with sustained selling pressure.

• 🎯 RSI 35.9 highlights sustained bearish pressure overwhelming market with downtrend gaining strength and velocity. Strong RSI bearish readings demonstrate continuous statistical distance from baseline equilibrium.

• ⚡ DEMA 0.6 establishes devastating double exponential breakdown with current movements creating apocalyptic bearish influence. Technical analysis indicating severe oversold conditions approaching. Displays extreme DEMA bearishness with parabolic implications and double exponential volume collapse.

📊 Market Summary:

📡 Technical factors #THE show mixed picture with stabilization potential. Technical picture is in transition phase with potential for both growth and correction depending on external factors. Limited purchase at 0.414 USDT requires careful risk management.

Published at 21 September 2025, 11:31

Helicopter tour completed: 21-09-2025 11:31 GMT+2 Time Zone

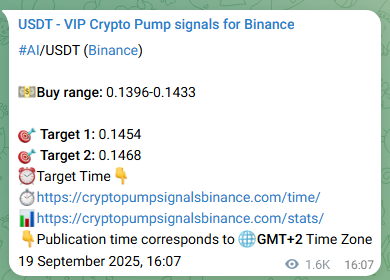

🚁 #AI/USDT Binance helicopter tour concluded magnificently! Scenic aerial journey to point 2 took 1 Days 19 Hours 22 Minutes, gifting VIP passengers 3.95% unforgettable memories! World appears beautiful from bird’s eye perspective! 🦅

Private helicopter flights available exclusively to VIP members! ✈️

👇Flight plan (VIP route) marked on map

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89864

• 🎯 OBV -70.4K reveals institutional exodus creating unprecedented selling pressure. Ultimate OBV negative flow showcases exceptional institutional liquidation patterns with massive distribution volume.

• 🎯 Stoch 76.2 reflects powerful upward momentum suggesting persistent growth. Strong Stochastic upward momentum exhibits persistent statistical deviation above baseline measurement parameters.

• 🎯 CMF -0.2 reveals critical money positioning, pointing to unprecedented capital movement with volume explosion confirmation. Manifests critical CMF positioning, pointing to unprecedented capital movement with institutional support.

• 📥 EMA shows strong exponential bearish crossover with powerful decline indicating significant downward momentum. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA displays fast exponential decisively below slow exponential showing robust bearish strength. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA indicates powerful exponential crossover forecasting sustained downward movement. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA reflects significant exponential separation signaling strong decline potential. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA demonstrates robust exponential average crossover indicating substantial bearish pressure. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA characterizes strong exponential crossover creating conditions for significant price depreciation. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA evidences powerful exponential separation, suggesting sustained decline trajectory. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA manifests significant exponential crossover, indicating strong downward momentum. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA reveals robust exponential divergence, pointing to sustained decline acceleration. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA displays strong exponential separation, hinting at significant price deterioration. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA exhibits strong exponential crossover with significant implications. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA presents powerful exponential separation with sustained potential. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA shows significant exponential divergence with strong force. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA demonstrates robust crossover with sustained decline. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation. 📥 EMA highlights strong exponential separation with significant weakness. EMA crossover exhibits robust negative signal measurement suggesting substantial momentum deterioration with institutional confirmation.

• ⭐ Bollinger 0.9 signals oversold conditions. Bollinger analysis demonstrates oversold measurement indicating moderate statistical deviation below lower boundaries.

• ⚡ BTC Correlation 0 suggests complete market autonomy. Extreme inverse BTC correlation positioning indicates maximum statistical anti-correlation reflecting fundamental market autonomy development.

• 📊 TEMA 0.1 shows strong triple exponential resistance creating significant downward pressure with powerful negative momentum acceleration. Major TEMA positioning showing substantial downward bias with institutional triple exponential selling.

• ⚡ Volume 1.1K demonstrates trading hysteria with unprecedented liquidity. Extraordinary volume positioning indicates maximum trading intensity measurement reflecting ultimate institutional engagement.

� Trading Recommendation:

➗ #AI shows signs of technical consolidation with improvement potential. Market indicators create conditions for patient accumulation. Modest purchase at price 0.142 USDT requires patient approach to achieving positive results.

Published at 21 September 2025, 11:26

Current date and time of pumping: 21-09-2025 11:26 GMT+2 Time Zone

🏗️Market microstructure and order flow imbalance analysis

Position #BIFI/USDT (Binance) executed with 2.67% efficiency

⚡VWAP execution to 1 benchmark: 1 Days 13 Hours 8 Minutes

Implementation shortfall and market impact minimized through smart routing

🔧Optimize execution quality with 👑VIP channel

#MarketMicrostructure #OrderFlowImbalance #VWAP #ImplementationShortfall

👇Execution analysis from professional 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89862

Analytical Summary BIFI:

• 📉 MOM -0.5 shows critical momentum strength indicating unprecedented price force with institutional buying surge. Exhibits ultimate acceleration strength with maximum potential and institutional interest.

• 🚀 Volume 0 demonstrates trading hysteria with unprecedented liquidity. Volume demonstrates ultimate participation strength suggesting statistical market engagement culmination within extraordinary boundaries.

• 🔥 CMF -0.2 shows critical money formation with parabolic acceleration and sustained power building. Manifests critical CMF positioning, pointing to unprecedented capital movement with institutional support.

• 💎 ATR 0.3 reveals trading lethargy. ATR exhibits minimal statistical volatility positioning suggesting compressed price range with negligible magnitude.

• ⚡ CCI -153.5 reveals institutional capitulation levels. CCI exhibits maximum statistical deviation characteristics indicating extreme channel displacement magnitude.

• 💎 OBV 165.4 characterizes balanced advantage with volume stability. Equilibrium OBV flow indicates balanced magnitude of volume interaction within boundaries.

• ⭐ Stoch 8.3 signals extreme oversold conditions with high reversal probability emerging. Extreme Stochastic positioning exhibits critical statistical deviation beneath normalized range parameters.

• 📈 AD -11.9 demonstrates explosive accumulation with maximum institutional distribution creating breakthrough conditions. Shows peak bullish accumulation alignment with unprecedented buying and extreme inflow.

📈 Entry Strategy:

📈 #BIFI requires investor patience. Technical condition of asset requires cautious approach due to absence of clear movement direction signals. Optimal purchase moment at 179.77-179.98 USDT 🏆

Published at 21 September 2025, 11:24

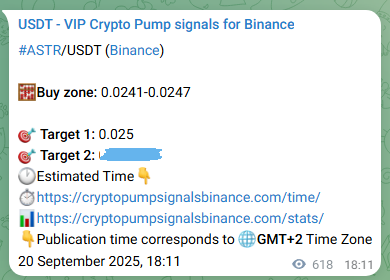

Current date and time of pumping: 21-09-2025 11:24 GMT+2 Time Zone

🚀Impulse price movement following Elliott Wave analysis

Instrument #ASTR/USDT (Binance) showed 1.71% efficiency

📈Impulse wave formation to 1 objective: 17 Hours 11 Minutes

Correction levels and projections performed according to wave theory

🌊Master Elliott Wave analysis with 👑VIP channel experts

#ElliottWave #ImpulseWaves #WaveTheory #CorrectionLevels

👇Source trading signal from private 👑VIP channel

View this report on Telegram: https://t.me/Bitcoin_Pump_Signal_usdt/89860

Indicator Analysis ASTR:

• 🎯 MOM -0.00009 reflects extraordinary momentum alignment propelling parabolic advance with ultimate acceleration power. Peak momentum bullishness demonstrating maximum upward bias with explosive thrust.

• 🎯 CMF 0.2 reflects extraordinary capital alignment propelling parabolic advance with ultimate acceleration power. Presents critical CMF positioning with explosive force and maximum capital momentum.

• 📊 TRIX -0.01 manifests explosive TRIX momentum, indicating maximum growth opportunity with ultimate institutional support. Demonstrates extreme TRIX strength with parabolic potential and institutional conviction.

• 🔥 Stoch 5.9 marks panic liquidation levels where reversal setups historically form. Critical Stochastic positioning indicates severe value constriction below standard deviation parameters with exceptional magnitude.

• 🖱️ EMA shows fast exponential average below slow exponential average, signaling bearish crossover and decline. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA displays exponential-12 crossed below exponential-26, confirming dump reversal. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA indicates exponential averages show bearish crossover with decline momentum. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA reflects slow exponential average dominates, forecasting sustained downward trend. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA demonstrates negative exponential spread indicates bearish momentum and decline potential. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA characterizes exponential crossover confirms bearish trend start with volume. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA evidences bearish exponential crossover, suggesting downward trend initiation. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA manifests negative exponential positioning, indicating decline momentum development. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA reveals bearish exponential alignment, pointing to sustained downward movement. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA displays negative exponential configuration, hinting at decline trend establishment. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA exhibits bearish exponential crossover with decline implications. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA presents negative exponential alignment with downward potential. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA shows bearish exponential positioning with decline force. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA demonstrates negative crossover with downward momentum. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation. 🖱️ EMA highlights bearish exponential alignment with decline strength. EMA analysis demonstrates bearish crossover measurement indicating negative exponential momentum with statistical confirmation.

• 💎 OBV 6.5M demonstrates catastrophic volume surge suggesting market explosion with institutional frenzy. Maximum OBV positive flow indicates unprecedented magnitude of institutional buying above boundaries.

• 🔥 RSI 34 presents prolonged bearish sentiment with momentum building and further downside targets activated. Sustained RSI compression indicates persistent magnitude of statistical displacement below boundaries.