Bitcoin After a price surge that captivated the market, has entered a short consolidation phase. The The rally followed two important events: Former President Donald Trump’s The victory in the U.S. elections and the Federal Reserve’s Decision to reduce interest rates These BTC has reached new heights as a result of the positive developments across all markets.

Related Reading: Excess Global Liquidity Fuels Bitcoin Growth – Key Data Reveals M2 Is Rising

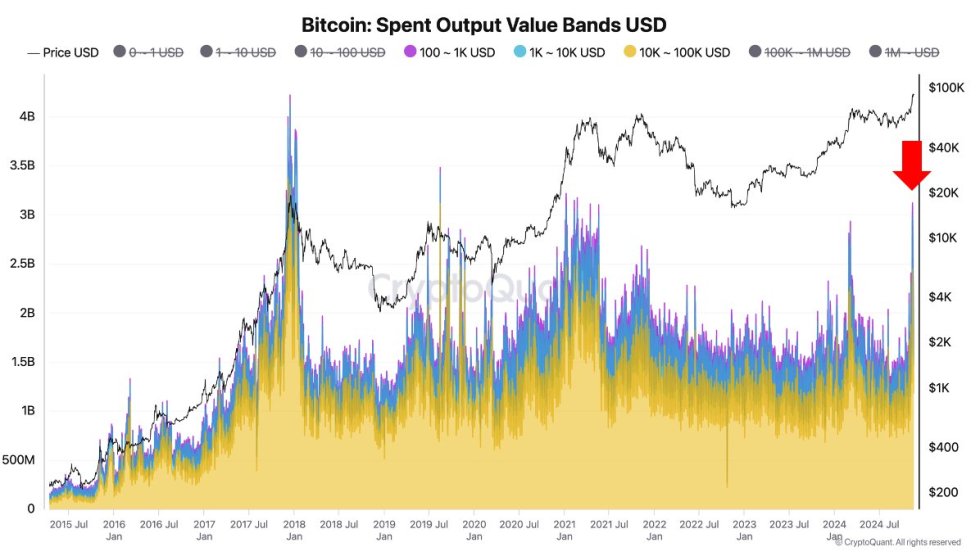

Key CryptoQuant data Founder Ki Young Ju This article provides more insight into the underlying drivers of this rally. According The following are some of the ways to get in touch with us: JuRetail investors are returning in droves to the market, a strong indication that Bitcoin’s The recent surge in the stock market is not a temporary event, but rather the beginning of a longer-lasting bull run.

HistoricallyBTC’s explosive growth phases have coincided with increased retail activity, giving it more weight in the narrative that there will be further gains.

Analysts The strong demand and favorable macroeconomic conditions that support the bullish momentum. While Although the price may be subject to short-term fluctuations, the influx in retail investors indicates a strong basis for the next phase of the rally. Bitcoin’s The company’s growing popularity and resilience reinforces its position as an innovator in the financial landscape.

Bitcoin Party Has Just Started

Bitcoin After breaking all-time records multiple times in the past two week, has confirmed a rally. This Many investors believe that the recent surge is only the beginning of an even larger upward movement. Some predict that BTC will reach $100,000 in the next few weeks.

The The rally has been characterized by a strong momentum. It has consistently set new price levels, and demonstrated resilience despite possible market corrections.

Data CryptoQuant CEO CryptoQuant CEO Ki Young Ju This suggests that retail investors have begun to play a greater role in the current rally. According The following are some of the ways to get in touch with us: Ju, Bitcoin’s The volume of transactions below $100K has increased by three years, which indicates that retail participation in the market is increasing. Retail Investors have traditionally been a major driver of Bitcoin’s When they enter the market it often leads BTC and to massive gains in the broader cryptomarket.

Bitcoin Transaction volume below $100K reaches a three-year high| Source: Ki Young Ju On X

Bitcoin Transaction volume below $100K reaches a three-year high| Source: Ki Young Ju On X

This Increased retail activity could be a sign of a new euphoric phase in BTC, similar to previous bull markets. As BTC’s price could rise if retail investors start to show an interest. This would fuel the bullish market sentiment.

Related ReadingBlackRock Bitcoin ETF Hits $40 Billion In Assets – Institutional Demand Playing You can also find out more about the A-Team here. Key Role

With Bitcoin Breaking new highs and increasing retail interest has set the stage for a potentially explosive move towards $100,000. If If the current momentum is maintained, it could bring BTC into a new growth stage, creating new opportunities and further cementing its position as the top digital asset.

BTC Testing Crucial Supply

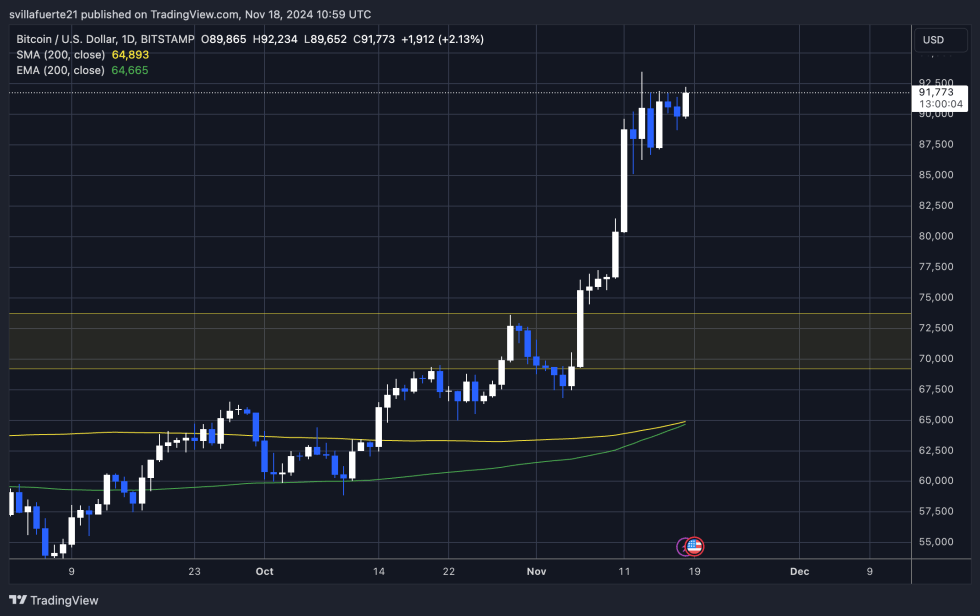

Bitcoin After several days’ consolidation, the price reached $91,777. This BTC’s upward trend is likely to continue due to the increasing demand and influx of retail traders entering the market.

BTC testing critical supply levels| SourceTradingView: BTCUSDT Chart

BTC testing critical supply levels| SourceTradingView: BTCUSDT Chart

As The price tests key levels of supply near the ATH. It faces vital support at the $87,000 level, a demand level that could push BTC to the psychological level of $100,000. Holding This level is essential for maintaining upward movement and confirming bullish outlook.

If If BTC loses its support at $87,000 it could prolong the current consolidation phase, or even trigger a correction due to lower demand levels. This could potentially stop further price advancements.

Related Reading: Bitcoin Surpasses $1.79 Trillion Oil Giant Saudi Aramco – Can BTC Climb Up And Pass Gold?

The coming days will be critical as the market evaluates BTC’s ability to hold above this key level. If successful, a break above $95,000 could lead to a push towards $100,000 and solidify the bullish trend. HoweverInvestors who closely monitor the market may become more uncertain if support is not maintained.

Featured Image from DallChart from TradingView -E

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.