Cryptocurrencies and cryptocurrency trading have become a popular way to invest and make money. However, there are many strategies and approaches to trading, and finding the optimal path to success can be challenging for beginners.

One approach that stands out from the crowd is the use of crypto pump signals on the popular platform Binance. Crypto pump signals are signals that alert traders to an upcoming increase in the price of a specific cryptocurrency. Such signals can be very useful for traders, enabling them to make informed decisions and profit from changes in cryptocurrency prices.

However, in order to use crypto-pump signals on Binance, you need to have certain knowledge and skills. In this expert review, we will discuss the basic principles of using crypto-pump signals on Binance and share with you tips and recommendations for trading in the cryptocurrency market.

Crypto-pump signals are typically provided by a group of traders or analysts who have access to a large volume of market information. They research and analyze various factors, including technical and fundamental analysis, to determine when an abnormal price movement will occur. They then send signals to their subscribers, indicating which cryptocurrency to buy or sell and at what level to set stop-loss and take-profit.

The main goal of crypto pump signals is to help traders earn profits from the volatility of the cryptocurrency market. They provide traders with the opportunity to catch the moment when prices are rising and close positions with a profit. However, it should be remembered that the cryptocurrency market is highly risky, and the use of crypto pump signals does not guarantee profits.

Advantages of using crypto pump signals

Crypto pump signals offer traders several significant advantages:

- Increased chances of profitability: Crypto pump signals provide information about upcoming pumps, allowing traders to profit from rapid price increases. This can be especially useful for traders who do not have enough time or experience to independently analyze the market and find suitable trading opportunities.

- Improvement in quality of decision-making: Crypto pump signals provide traders with information about specific assets that are likely to experience significant price growth in the near future. This enables traders to make more informed decisions about entering and exiting positions based on objective information.

- Reduction in time spent on market analysis: Market analysis requires significant time and effort. Crypto pump signals allow traders to reduce the time spent on searching for and analyzing promising assets, and focus their efforts on decision-making and portfolio management.

- Access to Expert Information: Crypto pump signals provide traders with access to expert information and analysts who have experience and knowledge in the cryptocurrency market. Traders can learn the opinions of professionals about specific assets and use this information to make better decisions.

- Risk Management: Crypto pump signals provide traders with information about potential risks and recommendations for risk management. This can help traders reduce losses and improve the risk-reward ratio of their trading strategies.

In general, the use of crypto pump signals can be beneficial for traders who want to increase their chances of making a profit, reduce the time spent on market analysis, and gain access to expert information. However, traders must remember that crypto pump signals are not guaranteed profitable tools and require thorough research and evaluation before making decisions to enter and exit positions.

How crypto pump signals work

The main idea behind crypto pump signals is to predict the future price movement of a cryptocurrency and give traders signals on when to buy or sell the asset. Typically, these signals are in the form of notifications that can be sent via email, messenger, or displayed on a trading platform.

Signals are provided by experienced traders who analyze the market and look for specific patterns or signals that indicate a possible change in the price of an asset. They use various tools and strategies to forecast market movements.

Crypto pump signals can be both paid and free. Paid signals are provided by professional traders or signal groups that have a proven track record of profitability and reputation. Free signals are typically provided by newcomers or traders who want to attract clients with their signals.

Traders who receive a signal can choose whether to follow it or not. They can also use signals in combination with their own market analysis and strategy. It is important to consider that crypto pump signals do not guarantee profit and the trader should always assess their risks before making a decision to buy or sell an asset.

In general, crypto pump signals can be a useful tool for traders, helping them make informed decisions in the cryptocurrency market. However, they should be used with caution and should not be the sole factor determining trading decisions.

Choosing a platform for working with crypto pump signals

There are several platforms that provide services for processing and transmitting crypto pump signals in the Binance market.

Before choosing a platform, several factors should be considered:

- Reliability: the platform should have a good reputation, be proven, and safe to use

- Signal quality: the platform should provide accurate and reliable signals with minimal false signals

- Ease of use: the platform should be user-friendly and provide a convenient interface for working with signals

- Functionality: the platform should offer various tools and opportunities for market analysis and working with signals

- Cost: the platform should provide different pricing plans with different features and prices to meet the needs of different traders

Most platforms offer both free and paid plans. Free plans typically come with a limited set of features and signals, while paid plans provide a wider range of features and more accurate signals.

Before choosing a platform, it’s worth reading reviews and ratings, as well as determining your goals and requirements for working with crypto pump signals.

Some of the popular platforms for working with crypto pump signals on the Binance market include:

- Binance Pump Signals

- Signal Groups

- Signals Premium

- PumpKing Community

Each platform has its own features and advantages, so it is recommended to thoroughly research each one before making a final decision.

Choosing a platform to work with crypto pump signals is a serious step for every trader. But with the right approach and sufficient research, you can find a platform that meets your requirements and helps you achieve the desired results.

Market analysis before using crypto pump signals

Before using crypto pump signals on Binance, it is very important to conduct market analysis. This will help determine the suitable moment to enter a trade and minimize risks.

Firstly, it is necessary to study the overall market dynamics. When analyzing market statistics, various factors should be taken into account, such as asset prices, trading volumes, changes in market capitalization, and price stability. This will help get an idea of the current state of the market and its predictable trend.

In addition, it is necessary to study news and events that may influence the market. These can be project announcements, updates to legislation, regulation, or other important events that can cause price fluctuations. Analysis of fundamental data will help assess the potential market reaction to these events.

It is also important to analyze technical indicators and charts. Technical analysis allows you to identify various trends, resistance and support levels, as well as other technical indicators that can help make a decision about entering or exiting a trade.

Don’t forget about the importance of the overall market context. For example, if the market is in a stable upward trend, using crypto pump signals may be more effective. However, if the market is in a downward trend or a period of instability, caution should be exercised when using signals.

In general, analyzing the market before using crypto pump signals on Binance allows you to assess the current market situation, identify possible risks, and make an informed decision about the deal. This will help increase the chances of successful trading and maximize potential profit.

Difference between free and paid crypto pump signals

However, there is a difference between free and paid crypto pump signals. Let’s consider the main differences between them:

1. Signal quality

Paid signals usually provide more quality information, as providers need to justify the fee to their clients. They undergo deep market analysis, use various methods and strategies to predict possible price changes, and recommend specific trades.

Free signals can be less accurate or unbiased as their providers may not have the motivation to conduct thorough market analysis or may hide information about their strategy to make a profit.

2. Availability of Information

Free signals are usually available to anyone interested in using them. Paid signals may be available only to subscribers or traders who pay a certain amount for access to information.

This means that free signals can be more competitive and less profitable, as a large number of people can use them and follow them. At the same time, paid signals may provide less competition and more opportunities for profit.

3. Customer Support

Paid signals often provide additional support to clients in the form of consultations, training, or access to exclusive materials. Free signals may not provide such support, and traders may be left alone with the information they have received.

4. Risk Level

Paid signals usually warn about potential risks and provide recommendations for risk management. In free signals, this information may be limited or completely absent.

It is also worth noting that paid signals may be more reliable in terms of providing up-to-date information, as providers are interested in maintaining their reputation and level of trust among clients. Free signals may be less reliable or contain outdated information.

In general, paid crypto pump signals usually offer higher quality information, access to exclusive data, and additional customer support. However, they require additional financial expenses. Free signals may be available to everyone, but their quality and reliability may be less predictable.

Risk Levels When Using Crypto Pump Signals

Using crypto pump signals is associated with certain levels of risk that traders should consider before deciding to use them. Let’s consider the main risks associated with using crypto pump signals:

1. Market Risks

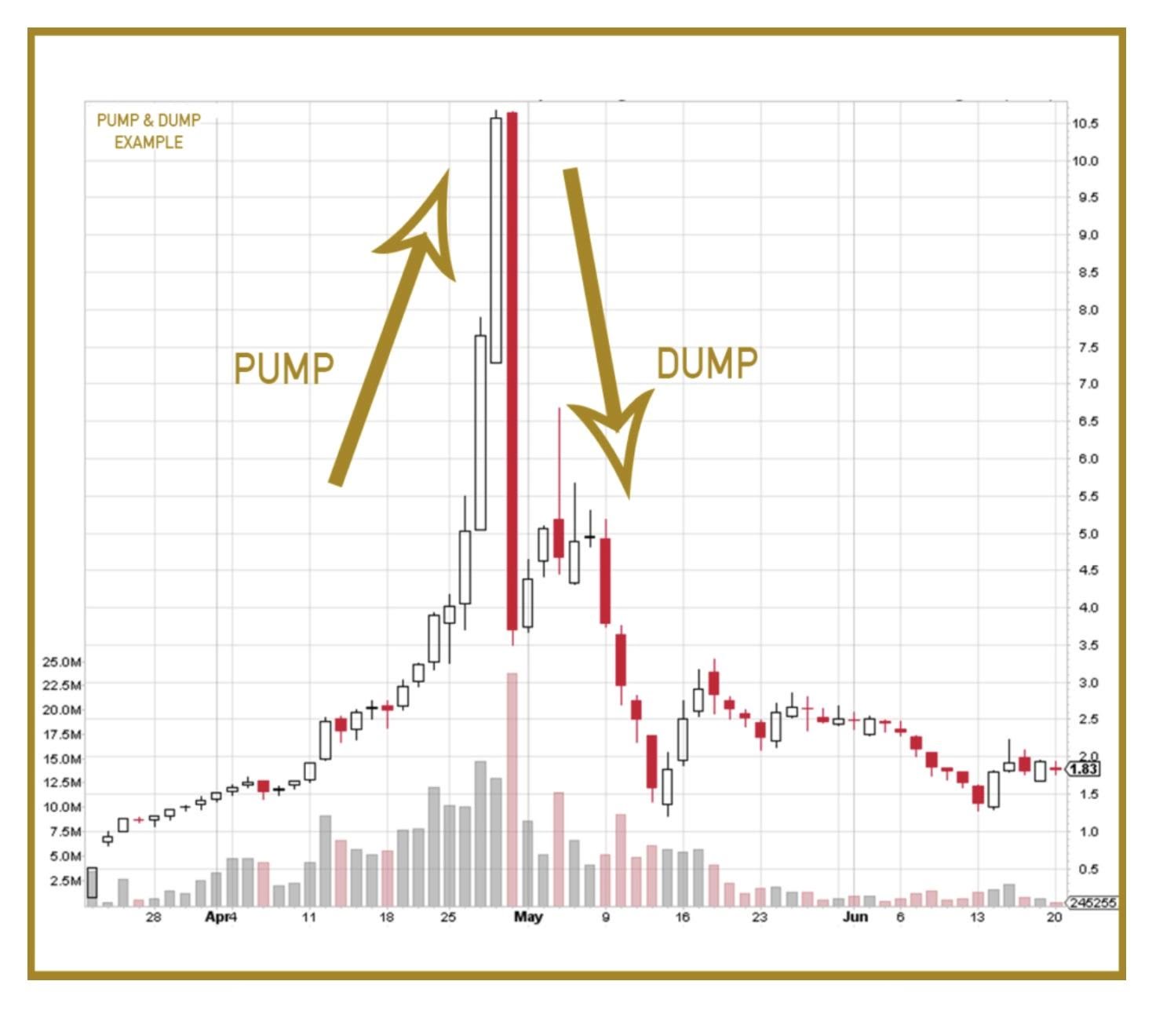

Crypto pump signals are based on the assumption of price growth as a result of manipulative operations. However, market conditions can change, and traders may face unforeseen price fluctuations. This can lead to capital loss.

2. Fraud Risks

In the world of cryptocurrencies, there are many fraudsters who try to use crypto pump signals for their own benefit. Traders must be cautious and choose reliable and verified sources of signals to avoid fraud and loss of funds.

3. Trading Psychology Risks

Traders must be prepared for the psychological aspects of trading associated with using crypto pump signals. The possibility of rapid price changes and numerous transactions can cause emotional stress and lead to making erroneous decisions.

4. Signal Miss Risks

Crypto pump signals can come in quickly and require immediate action. If a trader fails to make a decision in time or does not receive enough up-to-date information about the signal, they may miss an opportunity to earn or incur losses.

It is important to remember that crypto pump signals are not a guarantee of profits and require additional research and analysis. Traders should always assess risks and make informed decisions based not only on signals, but also on their own market analysis and experience.

Technical analysis in crypto pump signals

Types of indicators

Various indicators are used in technical analysis of crypto pump signals to help traders make trading decisions. Some of the most popular indicators include:

| Indicator name | Description |

|---|---|

| Moving Average | Shows the average price value over a specific period of time. Allows the trader to determine the overall trend direction. |

| RSI (Relative Strength Index) | Showcases the relative strength of an asset and helps determine if the asset is overbought or oversold. |

| MACD (Moving Average Convergence Divergence) | Allows a trader to determine if the price of an asset is straying from common fluctuations and if it is a signal to buy or sell. |

| Volumes | Analyzes trading volumes and helps determine how active a market is and how popular a particular coin is. Can be used to confirm signals. |

Using technical analysis

In crypto pump signals, traders can use technical analysis to make decisions about entering and exiting a trade. Technical analysis can help identify trends, determine overbought and oversold levels of an asset, and predict potential support and resistance levels.

One way to use technical analysis in crypto pump signals is to combine different indicators to confirm a signal. For example, if the moving average crosses below the asset’s price and the RSI indicates that the asset is overbought, this may be a signal to sell.

It is also important to consider that technical analysis does not always provide accurate forecasts. The cryptocurrency market is very volatile and susceptible to various influences, so traders should use technical analysis in combination with other aspects of analysis, such as fundamental analysis and market events.

Fundamental Analysis in Crypto Pump Signals

Unlike technical analysis, which relies on charts and statistical price movements, fundamental analysis analyzes a broader set of data to understand the intrinsic value of an asset.

In the context of crypto pump signals, fundamental analysis helps traders identify assets with high growth potential and profitability. It allows discovering stocks, tokens, or coins that have fundamental reasons for price growth.

When using crypto pump signals with fundamental analysis, traders examine financial reports, news, and events related to the project or company, as well as analyze the market situation and industry prospects. This allows them to make informed decisions about buying or selling assets.

Fundamental analysis also helps traders determine the fair value of an asset and distinguish overvalued and undervalued assets. This allows them to make successful trades and earn a profit.

However, it is important to understand that fundamental analysis is not the sole factor determining success when using crypto pump signals. It should be used in combination with other analysis methods, such as technical analysis and the trader’s own experience.

How to choose the right crypto pump signal

When choosing a suitable crypto pump signal on Binance, it is necessary to consider several factors that will help make an informed choice and increase the chances of success. Here are a few important questions to pay attention to when choosing a crypto pump signal:

1. Signal provider’s reputation

Before choosing a crypto pump signal on Binance, it is recommended to conduct some research and evaluate the signal provider’s reputation. There are many fraudulent companies in the market, so it is important to be cautious and select reputable and trusted providers.

2. History of results

Review the signal provider’s history of results to assess its effectiveness. Make sure the provider regularly provides accurate and profitable signals. Use past results as one of the key factors in making a decision.

3. Strategy Analysis

Review the principles and strategies used by the signal provider. Make sure they align with your needs and risks. Some providers offer conservative strategies, while others prefer aggressive approaches. Choose one that meets your requirements and trading strategies.

4. Access to additional information

Check if the provider offers additional materials or education that will help you better understand and utilize crypto pump signals. Education and additional information can be valuable resources for your trading and skill enhancement.

Consider all these factors when choosing a suitable crypto pump signal on Binance to increase your chances of success and earn profits from cryptocurrency trading.

Correct strategy for using crypto pump signals

When using crypto pump signals, it is important to have a proper strategy in order to reduce risks and increase the likelihood of making a profit. Here are a few recommendations for developing an effective strategy:

| 1. Research the market |

|---|

| Before using crypto pump signals, it is necessary to analyze the market. Study the assets that the signals are indicating and learn about their fundamental and technical characteristics. This approach will help you make informed decisions when using crypto pump signals and avoid potential risks. |

| 2. Understand technical analysis |

| Technical analysis is an important component when using crypto pump signals. Study various indicators and patterns to determine the appropriate timing for entering and exiting a trade. Technical analysis helps you make informed decisions and improve your results. |

| 3. Set appropriate take profit targets and stop losses |

| Identify take profit levels and stop losses that align with your strategy and the risks you are willing to take. Setting these levels will help protect your investments and lock in profits in the event of a successful trade. |

| 4. Diversify your portfolio |

| Do not rely solely on crypto pump signals when forming your portfolio. Asset diversification will help you spread risks and increase the likelihood of profit. Use multiple strategies and tools to achieve maximum results. |

| 5. Pay attention to timing |

| Successful timing of entry and exit from a trade is an important factor for success when using crypto pump signals. Monitor timeframes and market changes to make trades at the most opportune moment. Paying attention to timing will help you get the maximum return from crypto pump signals. |

| 6. Learn and improve |

| Professionalism in trading is achieved through practice and continuous learning. Explore new strategies, analytical tools, and technologies to improve your skills and results. Be ready to adapt to market changes and continually evolve as a trader. |

By following these recommendations, you will be able to develop an effective strategy for using crypto pump signals and improve your results in cryptocurrency trading.

Timing of Entry and Exit When Using Crypto Pump Signals

The timing of entry determines the moment when a trader should make a purchase of an asset based on signals. This is the moment when the price of the asset has not yet started to rise rapidly, but there are already signs of growth that indicate the beginning of a pump.

The exit timing determines the moment when a trader should sell an asset to make a profit. This is the moment when the asset price is at its peak or starts to decline after a pump.

Determining the optimal timing for entry and exit is a complex task that requires a trader to analyze the market, be able to recognize trends, and make decisions based on their knowledge and experience.

One approach to determining timing is to apply technical analysis, which allows a trader to identify important support and resistance levels, as well as trends on the asset’s chart. Technical analysis can help a trader determine the optimal moment to enter and exit a position.

In addition, fundamental analysis can be useful in determining the timing of entry and exit. Fundamental analysis allows evaluating the fundamental indicators of an asset, such as a company’s financial results or news about a project that can affect its price.

Proper timing of entry and exit based on crypto pump signals requires a trader to be attentive, able to clearly analyze the market, and make decisions based on their trading strategy. Traders should consider various factors such as the time of day, trading volumes, and the liquidity of the asset.

It is important to remember that the timing of entry and exit can vary greatly depending on the chosen asset and market trends. Therefore, traders should constantly analyze the market and update their strategy according to changing conditions.

In the end, proper timing of entry and exit is one of the fundamental aspects of successful trading using crypto pump signals on the Binance exchange. Traders should constantly improve their market analysis skills and develop their strategy to achieve maximum profit from trading.

Portfolio management using crypto pump signals

One of the key tasks of portfolio management is diversification of investments. Dividing the portfolio into different assets allows for risk reduction and increased potential for profit. When using crypto pump signals, you can distribute your investments among different projects to maximize opportunities for profitable trading.

For successful portfolio management, it is also important to set goals and a trading strategy. You must decide what percentage of your portfolio you are willing to risk on each trade and stick to that decision. Some traders prefer to set a hard limit on losses to protect their capital, while others prefer to use stop-loss orders.

Additionally, you can use fractions to allocate your portfolio based on risk and expected return. For example, you can allocate more funds to assets with higher profit potential but also higher risk, and less funds to assets with lower profit potential but lower risk.

Profit-taking and stop-losses in crypto pump signals

When using crypto pump signals, it is important to know how to properly set profit-taking levels and stop-losses. Profit-taking is the price level at which you want to exit a trade to lock in profits. Stop-loss is the price level at which you want to exit a trade to limit losses.

The definition of profit take and stop loss is a subject of every trader’s trading strategy. You can use technical analysis and fundamental analysis to determine profit take and stop loss levels. Technical analysis involves studying price charts, indicators, and other technical data to determine optimal levels. Fundamental analysis involves studying financial statements, news, and other factors that may affect the price of an asset.

Properly defining profit take and stop loss allows you to manage risks and protect your capital. If you don’t know when to exit a trade, you may either miss the opportunity to lock in profits or incur large losses. Therefore, careful study and practice of determining profit take and stop loss are very important when using crypto pump signals.

Take Profit and Stop Loss in Crypto Pump Signals

Take profit is a level at which a trader plans to close their position and secure their profit. It can be set based on technical or fundamental analysis, as well as based on previous market movements. It is important to set take profit at a level of achievable profit, but not be too greedy to avoid losing potential profit due to premature position closing.

Stop loss – is a level at which a trader plans to close their position with minimal losses. It is set to limit losses in case of an unfavorable market movement. It is important to set the stop loss at a level that will reduce losses to acceptable values. Risk analysis and determining the stop loss level should be thorough and based on logic and market knowledge, not on emotions or intuition.

The importance of profit-taking and stop losses

Profit-taking and stop losses play an important role in risk and profit management when working with crypto pump signals. They allow the trader to control their positions and protect their capital from large losses.

Without proper use of profit-taking and stop-loss orders, a trader can face the risk of losing all of their capital, and sometimes even lead to bankruptcy. This is because cryptocurrency trading can be very volatile and unstable, and without loss control, a trader can become a victim of financial risks.

Rules for setting profit-taking and stop-loss orders

When setting profit-taking and stop-loss orders, traders should follow several important rules:

1. Maintain a risk-reward ratio. Plan profit-taking and stop-loss levels so that the potential profit is greater than potential losses. It is recommended to use a risk-reward ratio of at least 1:2. This means that potential profit should be at least twice as much as potential losses.

2. Consider market volatility. Market volatility can significantly impact the level of profit targets and stop-loss orders. Volatile markets may require larger profit targets and stop-loss levels to account for potential price fluctuations.

3. Do not adjust profit targets and stop-loss orders based on emotions. Plan your profit targets and stop-loss levels in advance and stick to them, even if unexpected market movements occur. Do not let emotions or panic affect your decision-making.

4. Periodically review profit targets and stop-loss levels. The market is constantly changing, so regular updates to profit targets and stop-loss levels may be necessary. Periodically analyze results and market conditions to determine if adjustments to profit targets and stop-loss levels are needed.

Proper use of profit targets and stop losses is one of the key factors for successful trading with crypto pump signals. These tools help traders manage risks and achieve their goals in cryptocurrency trading. They help maintain psychological stability and avoid emotional decisions based on fear or greed. Therefore, traders are advised to pay due attention to these tools and use them wisely when working with crypto pump signals.

How to avoid scams when using crypto pump signals

Crypto pump signals on Binance can be an effective tool for traders, allowing them to earn good profits in the cryptocurrency market. However, in the world of cryptocurrency, there are many fraudulent schemes associated with pump signals, so caution and vigilance are required when choosing a crypto pump signal provider.

Here are a few tips to help avoid fraud when using crypto pump signals:

- Research the provider: before using the services of a crypto pump signal provider, research their reputation and check reviews from other users. Find out how long the provider has been operating in the market and what results they have achieved.

- Beware of “too good to be true” offers: fraudulent crypto pump signal providers may promise unrealistically high profits or guaranteed success. Be cautious of providers who do not provide detailed information about their strategies and market analysis methods.

- Be skeptical of time constraints: if a provider gives too short time frames to react to signals or requires immediate payment, it may be a sign of fraud. Trustworthy providers usually provide enough time to study the signals and make informed decisions.

- Be cautious of promises of “guaranteed profit”: no one can guarantee profit in the cryptocurrency market, so be careful with providers that promise guaranteed results. Investing in cryptocurrency always involves risk, and no one can predict future price movements.

- Use your analytical tools: don’t rely solely on pump signals, use your skills and knowledge to analyze the market. Pump signals can serve as additional information, but should not be your sole source of decision-making.

By following these tips, you will be able to minimize the risks of fraud and protect your investments when using crypto pump signals on Binance. It is important to remember that thorough analysis and thoughtful decision-making are key factors for success in the cryptocurrency market.

Crypto pump signals on Binance: main features

Signals are usually provided by specific providers who offer subscriptions to their services. It is important to choose a reliable provider with a good reputation to avoid fraud and receive high-quality signals.

Main features of crypto pump signals on Binance:

- Provision of up-to-date information: Signal providers update information about pump signals in real time so that traders can react promptly and make profitable trades.

- Variety of trading pairs: Crypto pump signals provide information about various trading pairs, allowing traders to choose the most profitable and suitable tools for trading.

- Technical and fundamental analysis: Signal providers conduct technical and fundamental analysis of the market to evaluate potential opportunities for price growth in cryptocurrencies. This allows traders to make informed decisions when trading.

- Profit targets and stop losses: Crypto pump signals usually include recommendations for exit points in trades. Profit targets and stop losses help manage risks and protect profits.

- Analysis of past results: Traders can study past signal results to evaluate their effectiveness and make informed decisions about their use.

It is important to remember that crypto pump signals are not a guarantee of success. When using such signals, traders should evaluate the market independently and make decisions based on their own experience and knowledge. The cryptocurrency market is highly risky, so it is important to be prepared for possible losses.

Furthermore, the choice of a crypto pump signal provider plays an important role in achieving success. Traders should look for a provider with a good reputation, positive reviews, and a proven history of providing quality signals.

Using crypto pump signals on Binance can help traders increase their profits and reduce risks, but only with the right approach and informed decisions. It is important to consider market conditions, conduct technical and fundamental analysis, and not rely solely on signals, but make decisions based on your own analysis.

How to Improve Results Using Crypto Pump Signals

Crypto pump signals can be a useful tool for traders, allowing them to improve their trading results on Binance. In this article, we will tell you about several ways that will help you use crypto pump signals most effectively and increase your profitable trades.

1. Choose a crypto pump signal provider carefully

Before you start using crypto pump signals, it is important to carefully choose a provider. Explore their reputation, check reviews from other traders, and evaluate their performance over the past period. Choose a provider whose approach and signals align with your trading style and risk profile.

2. Analyze past results

Study the past results of the crypto pump signals provider to understand their effectiveness and reliability. Pay attention to successful and unsuccessful trades, as well as the overall profitability of the signals. This will help you make decisions about which signals to choose and how to use them correctly.

Also, pay attention to how the provider fulfills their promises and how accurate their signals turn out to be. The more accurate and timely the signals are, the higher the likelihood of a successful trade.

3. Follow the provider’s recommendations

Once you have chosen a provider and received signals, it is important to follow their recommendations. You need to know when and how to enter the market, as well as when and how to exit it. It is not advisable to make your own changes to the signals or ignore them. This can negatively affect the results of your trades.

4. Create a unique strategy

Every trader can have their own style and trading strategy. Therefore, it is important to adapt the signals to your needs and create a unique strategy. For example, you can use a combination of technical and fundamental analysis to make decisions about entering the market and choosing stop-loss and take-profit levels.

In addition, it is recommended to update your strategy in accordance with market changes and your own results. This will help you become a more adaptive trader and improve your results using crypto pump signals.

Using crypto pump signals on Binance can be an effective way to improve your trading results. However, to achieve maximum effect, it is important to carefully choose a provider, analyze past results, follow recommendations, and create a unique strategy. Only in this way can you achieve stable profit growth and enhance your trading skills on Binance.

Top 5 benefits of Crypto Pump Signals on Binance:

1. Signals from verified providers. Before using crypto pump signals, it is important to choose a reliable provider that provides accurate information about possible pump signals on Binance. Such providers usually have a good reputation and positive reviews from traders. They conduct thorough market analysis and provide their subscribers with high-quality information.

2. Unique signals. The best crypto pump signals on Binance provide unique information that is not available to all traders. Such signals can be based on fundamental and technical analysis, as well as other factors that influence the cryptocurrency market. Thanks to unique signals, traders can achieve significant profits.

3. Personal approach. Best crypto pump signal providers on Binance offer a personalized approach to each trader. They analyze the needs and goals of traders and provide recommendations based on this data. This approach allows traders to maximize profit and achieve their cryptocurrency market goals.

4. Constant support. Good crypto pump signal providers on Binance offer constant support to their clients. They answer questions, help with installation and configuration of signals, and provide their recommendations and advice. Such support helps traders overcome possible issues and maximize the potential of crypto pump signals.

5. Affordable cost. Best crypto pump signals on Binance have a reasonable price that ensures accessibility for all traders. Good providers do not overprice their services and offer various pricing plans that allow y

ou to choose the most suitable option for your individual trading requirements.

How to start using crypto pump signals on Binance

Using crypto pump signals on Binance can be an effective way to profit from cryptocurrency trading. To start using crypto pump signals on Binance, follow these simple steps:

- Sign up for Binance and create an account.

- Deposit funds into your Binance account to have funds for trading.

- Explore different platforms that offer crypto pump signals and choose the one that is suitable for your goals and needs.

- Subscribe to crypto pump signals provided by the chosen platform. This is usually done through a paid subscription.

- Receive signals and analyze them to determine which cryptocurrencies to focus on.

- Define your entry and exit strategy for trading positions based on the received signals.

- Execute trades on Binance according to the chosen strategy.

- Track the results of your trades and analyze them to improve your strategy and make more informed decisions in the future.

It is important to remember that using crypto pump signals does not guarantee profits and is associated with certain risks. Remember to conduct your own market analysis and gather additional information to make informed decisions.

Example of successful work with crypto pump signals on Binance

Let me give you an example of successful work with crypto pump signals on Binance:

Let’s say you are a trader and decided to use crypto pump signals to make a profit on the Binance exchange. You carefully studied the market and chose a signal provider that suits you. You took into account their reputation, signal quality, past results, and reviews from other traders. As a result, you chose a reliable and proven signal provider.

As soon as you received a signal to buy a certain cryptocurrency, you reacted instantly and made a purchase on Binance. You used a portfolio management strategy and diversified your investments among several cryptocurrencies to minimize risks.

You also set a take-profit and stop-loss to automatically close the position if market conditions changed. You used technical and fundamental analysis to make a decision on the timing of entry and exit from the position.

As a result, your position was successful and you made a profit. You sold the cryptocurrency at the reached take-profit, allowing you to lock in profits and avoid potential losses.

It is important to note that successful work with crypto pump signals requires experience, knowledge, and trading skills. In particular, you must be prepared for quick reactions, be able to analyze the market and make decisions based on data, as well as manage risks.

Remember that each deal can be unique, and past results do not guarantee future profits. Therefore, it is important to constantly improve your skills, study the market, and analyze past results in order to make the most informed decisions.

Choosing a reliable signal provider, using the right strategy, and managing risks will help you improve your results and achieve greater profits with the help of crypto pump signals on Binance.

Experienced traders on Binance crypto pump signals

Trader feedback

Most experienced traders believe that using crypto pump signals on Binance can be a useful tool for traders, especially for beginners. They note that these signals can help traders not only make a profit, but also learn about new promising projects and coins that may have good growth potential.

Traders note that crypto pump signals can pose a certain risk, and not all signals can be successful. They recommend choosing signal providers that have a good reputation and a history of successful trades.

Advantages of using crypto pump signals

Experienced traders note several key advantages of using crypto pump signals on Binance:

- Profit opportunities: Crypto pump signals can help traders identify opportunities for profitable trades and earn good income.

- Information about new projects: Crypto pump signals can provide traders with information about new promising projects and coins that may have great growth potential.

- Education and experience: Using crypto pump signals can help traders improve their skills and gain experience in cryptocurrency trading.

Experienced traders recommend beginners to familiarize themselves with the basic concepts of trading on the Binance exchange and the fundamental principles of market analysis before starting to use crypto pump signals. They also advise not to rely solely on signals, but to conduct their own research and market analysis.

Thus, experienced traders acknowledge that crypto pump signals can be useful tools for traders on the Binance exchange. They stress that using signals should be part of an overall trading strategy and traders should remain cautious and not rely solely on these signals.

How to get more profit using crypto pump signals

Crypto pump signals are a tool that can help traders earn more profit in the cryptocurrency market. However, to achieve the greatest success in using these signals, it is necessary to analyze past results.

Analysis of past crypto pump signals allows identifying common patterns and trends that can help predict future market movements. This can help traders make more informed decisions and make more accurate forecasts regarding which coins will pump in the future.

One of the main ways to analyze past results of crypto pump signals is to use charts and statistical data. A trader can study past pumps of different coins and analyze their price dynamics. This can help identify common patterns and understand what factors can influence the success or failure of a particular pump.

In addition, a trader can pay attention to fundamental factors that can influence the success of a crypto pump. For example, news about the project, its technologies, or partnerships can significantly affect the price of the coin. Studying such factors and their impact on past pumps can help the trader predict future pumps with greater accuracy.

Use of analytical tools

To analyze past results and forecast future pumps, various analytical tools can be used. For example, a trader can use charts and indicators to study price dynamics and search for technical features that may indicate future pumps.

Furthermore, there are numerous online services and platforms that offer analytical tools and data for analyzing past results of crypto pump signals. Traders can use these tools to improve their skills and obtain more accurate forecasts.

Education and earning from experience

Analyzing past results of crypto pump signals can be complex and require a certain level of knowledge and skills. Therefore, traders who want to profit more from these signals can make use of various educational materials and courses.

Education can help traders understand the fundamental concepts and methods of analyzing past results of crypto pump signals. It can also help traders identify their own trading strategy and style that may be most effective for them.

In addition, traders can profit from their experience by analyzing past results of crypto pump signals. They can share their knowledge and experience with other traders, helping them develop and improve their skills.

Ultimately, analyzing past results of crypto pump signals can be a useful tool for traders who want to earn more profits in the cryptocurrency market. It helps identify common patterns and trends, as well as determine factors that may influence the success of a pump. Combining analysis of past results with the use of analytical tools, education, and experience can help traders improve their results and earn more profits using crypto pump signals.

How to analyze past results of crypto pump signals

Analysis of past results of crypto pump signals can provide valuable information to traders who want to determine the effectiveness and reliability of a specific provider. This analysis will help traders make more informed decisions when choosing a provider and determine how reliable and accurate the signals they provide are.

The first step in analyzing past results of crypto pump signals is gathering data about the provider’s past signals. This may include information about the time the signal was sent, the asset price, recommended entry and exit times, and the actual trade result.

After collecting data, the trader can analyze the provider’s past results using various technical tools and methods. For example, the trader can construct charts and graphs to visually represent the results. The trader can also utilize statistical indicators such as the average percentage of profitable trades, the average percentage of losing trades, and the overall profitability of the signals.

Important factors for analyzing past results of crypto pump signals:

1. Profitability of signals: The trader should consider the percentage of profitable trades to determine the effectiveness of the provider. A high percentage of profitable trades can indicate the accuracy of the provider’s signals.

2. Reaction time: The trader should take into account the time between signal transmission and execution. Quick reaction to signals can be an important factor for success.

3. Consistency: Traders should analyze past results for consistency in provider signals. Consistency can be an indicator of reliability and provider skills.

4. Trade Size: Traders should also consider the trade sizes recommended by the provider. Large trades may present greater profit opportunities but may also carry more risk.

Analyzing past results of crypto pump signals is an important step when choosing a provider for trading. It helps the trader make an informed decision and improve their financial results. Traders should use this information in conjunction with other relevant information and analysis methods to make the best decision for their cryptocurrency trading on the Binance platform.

How to Choose the Best Crypto Pump Signal Provider

When choosing a crypto pump signal provider, there are several key factors to consider that can impact your trading strategy and results. Here are a few important aspects to keep in mind when choosing the best crypto pump signal provider:

1. Reputation and reliability: One of the most important aspects is the reputation and reliability of the crypto pump signal provider. Check reviews and ratings about the provider, and reach out to experienced traders to learn about their experience with the provider. It is also important to consider the provider’s tenure in the market and their results.

2. Signal Quality: It is important to analyze and evaluate the quality of signals provided by the provider. Successful crypto pump signal providers should have evidence of their results and provide up-to-date and accurate data. Also, pay attention to the frequency and accuracy of signals to ensure their reliability and effectiveness.

3. Analytical Tools: A good crypto pump signal provider should offer a wide range of analytical tools and data to help traders assess market conditions and make informed decisions. This may include technical analysis, fundamental analysis, charts, and other tools for more accurate forecasts.

4. Diversity of signals: Having access to diverse signals can be very useful for improving your trading strategy. Crypto pump signal providers that offer different types of signals (such as buying and selling signals, signals for opening and closing positions, stop-loss and take-profit signals) can provide more opportunities for successful trades.

5. Price and subscription: The cost of crypto pump signal provider services can vary significantly. Make sure you understand the subscription terms and cost, and take them into account in your financial planning. Also, pay attention to the possibility of a free trial version or a money-back guarantee, which can help you make a more informed decision.

6. Support and Communication: It is important to be able to contact the provider and get support in case of any questions or issues. Check what kind of support service is provided and how quickly and efficiently they respond to customer inquiries. Also, find out what type of communication is offered (such as email, chat, phone) to ensure that you can easily reach them according to your preference.

Following these recommendations will help you choose the best crypto pump signal provider that suits your needs and helps improve your trading strategy. Don’t rush with your choice, do some research and consult experienced traders to weigh all the pros and cons of different providers.

How to Avoid Mistakes When Using Crypto Pump Signals

Using crypto pump signals can be a profitable tool for traders on Binance, but it is important to avoid a number of mistakes in order to maximize your profits and minimize the risk of losses. In this section, we will discuss some key points to consider when working with crypto pump signals.

1. Research and verify the signal provider

Before selecting a crypto pump signal provider, it is necessary to research and verify their reliability and reputation. Study the provider’s history, read user reviews, and check if they have verified reliable results for their previous signals. Pay attention to the quality and accuracy of the signals, as well as the information provided by the provider about their strategy and trading approach.

2. Diversify your portfolio

To reduce risks when using crypto pump signals, it is recommended to diversify your portfolio and not rely solely on one asset or provider. Allocate your funds between several different assets and signal providers to reduce the possibility of losses in the event of unforeseen circumstances or unsuccessful trading.

3. Use stop losses and take-profit orders

It is important to use stop losses and take-profit orders when working with crypto pump signals. A stop loss will help protect your capital and limit losses in the event of unfavorable trading, while a take-profit order will allow you to lock in profits and exit the position in a timely manner. Set these levels in advance and adhere to them to avoid getting into a situation where trading becomes emotional and impulsive.

4. Be cautious with large investments

Using crypto pump signals does not mean that you should blindly trust the provider and immediately invest all your funds in one signal. Be cautious with large investments and manage your capital to avoid significant losses. It is recommended to start with small amounts and gradually increase investments as successful trades and results accumulate.

5. Conduct your own analysis

Do not rely solely on provider signals, conduct your own market and asset analysis. Use technical and fundamental analysis to get a more complete picture and make more informed decisions. Independent analysis will help you better understand the current market situation and be more flexible and adaptable to changes.

Following these recommendations will help you avoid common mistakes and make more informed and successful decisions when using crypto pump signals on Binance.

How to improve trading skills with crypto pump signals

Crypto pump signals are valuable tools for traders that provide information about upcoming increases and decreases in cryptocurrency assets for profit. However, it is important to understand that simply receiving a signal does not guarantee success.

To improve trading skills with crypto pump signals, it is necessary to follow several key principles and strategies:

- Trust verified signal providers: It is important to choose reliable signal providers who have proven experience and credibility of information. Explore the market and evaluate providers’ ratings before making a decision.

- Analyze and verify signals on your own: Do not rely solely on signals, conduct your own analysis and verification of information. Make sure the signal aligns with your personal strategies and goals.

- Create your own trading strategy: Use crypto pump signals as an addition to your own trading strategy. They should be integrated into the overall plan, considering risk levels and potential profit.

- Manage risk: Use stop-loss and take-profit orders to protect your position from significant losses and lock in profits in case of success.

- Learn and grow: Continuously study market trends, technical and fundamental analysis, and refine your skills. The more knowledge and experience you have, the better results you can achieve with the help of crypto pump signals.

Using crypto pump signals is an effective tool for traders, however, it is important to remember that effectiveness depends on various factors, including your own skills and knowledge. Improving trading skills with the help of crypto pump signals requires constant work on your skills and education. Follow a strategy, manage risk, and constantly develop to achieve success in trading on cryptocurrency markets.

Question and Answer:

What are crypto pump signals on Binance?

Crypto pump signals on Binance are signals about the upcoming price increase of a specific cryptocurrency that are sent to traders. They can be helpful for traders who are looking to profit from the price increase of a cryptocurrency.

How to use crypto pump signals on Binance?

To use crypto pump signals on Binance, you must be a registered user of the exchange. After that, you need to subscribe to channels and receive signals that recommend buying specific cryptocurrencies, and follow these recommendations.

Are crypto pump signals on Binance reliable?

The reliability of crypto pump signals on Binance depends on the source of the signals. Some signals may be created by inexperienced traders or even scammers with the intention to manipulate prices. Therefore, it is important to be cautious and conduct your own research before following signal recommendations.

Can you make money using crypto pump signals on Binance?

Earning money using crypto pump signals on Binance depends on your trading strategy and proper application of these signals. Some traders claim to make profits by following signal recommendations, but it is not guaranteed. It is important to remember that cryptocurrency trading always carries risk, and earning is not guaranteed.

How to choose a reliable source of crypto pump signals on Binance?

To choose a reliable source of crypto pump signals on Binance, you should conduct research and read reviews from other traders. Look for trusted sources with a good reputation and verify the accuracy of the signals they provide. It is also important to be cautious and not rely solely on signals, conducting your own market analysis before making a decision.

What are crypto pump signals on Binance?

Crypto pump signals on Binance are buying signals that are provided to traders so that they can participate in so-called “pumps” or sudden price spikes in certain cryptocurrencies.

How to use crypto pump signals on Binance?

To use crypto pump signals on Binance, traders need to subscribe to a platform or group that provides these signals and follow instructions on buying or selling certain cryptocurrencies at a specified time.

What advantages can the use of crypto pump signals on Binance provide?

Using crypto pump signals on Binance can give traders the opportunity to make significant profits in a short period of time if they allocate their funds correctly and can react quickly to signals.

What risks are associated with using crypto pump signals on Binance?

Using crypto pump signals on Binance also comes with risks, as traders may encounter unforeseen situations, including subsequent price dumps, liquidity issues, or price manipulations.

How to choose a reliable provider of crypto pump signals on Binance?

To choose a reliable provider of crypto pump signals on Binance, traders should conduct a thorough preliminary assessment and study the reputation of the provider, check reviews, and find out what strategies and methods are used to generate signals.

Every trader who trades cryptocurrency on the Binance exchange wants to know about the upcoming pumping in the value of coins in order to make huge profits in a short period of time.

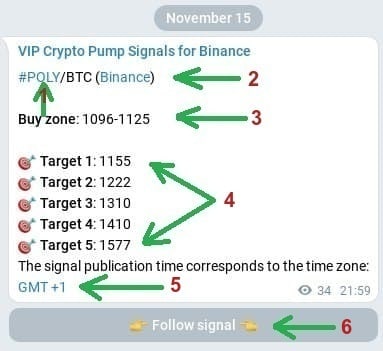

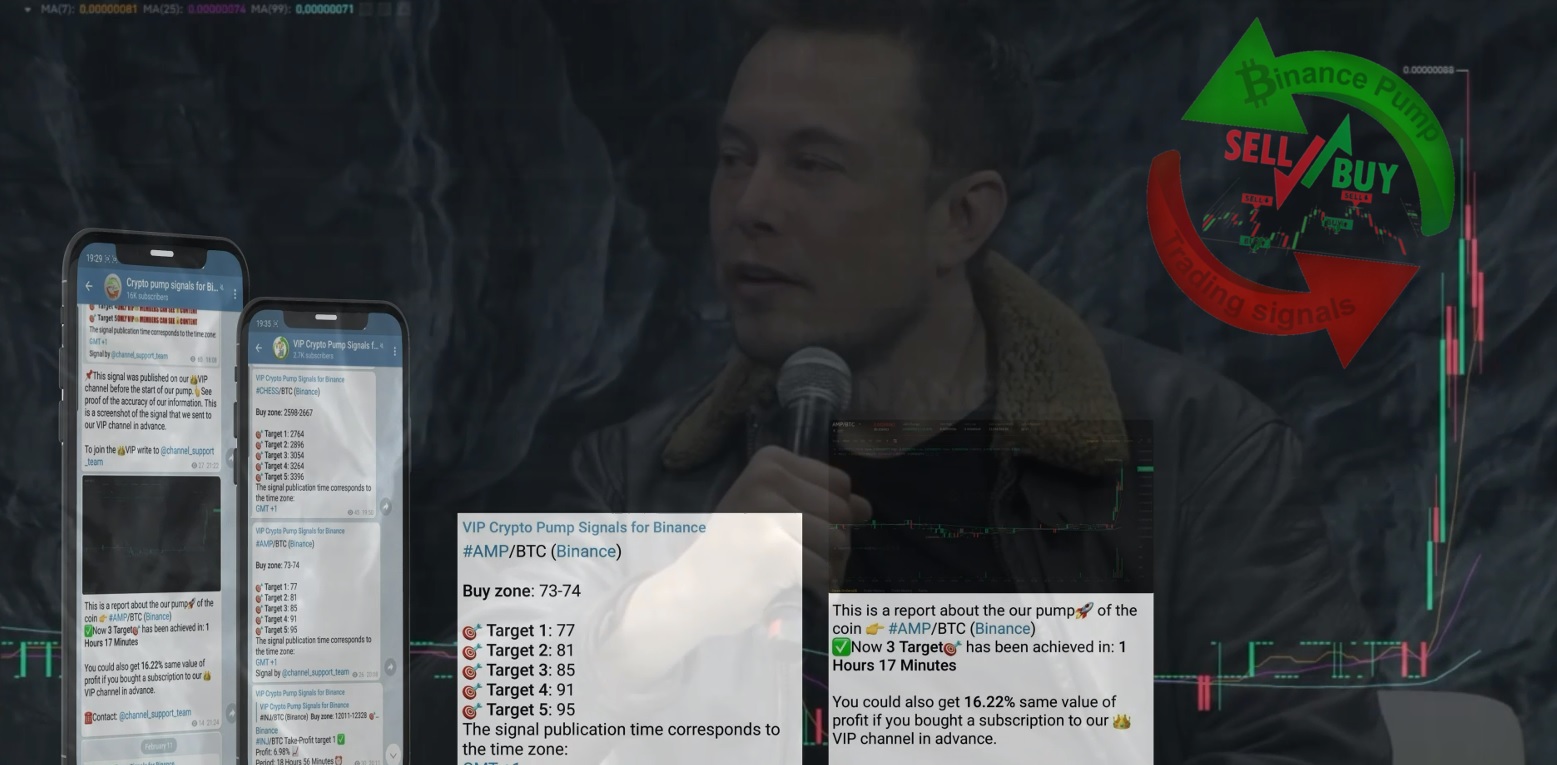

This article contains instructions on how to find out when and which coin will participate in the next “Pump”. Every day, the community on Telegram channel Crypto Pump Signals for Binance publishes 10 free signals about the upcoming “Pump” and reports on successful “Pumps” which have been successfully completed by the organizers of the VIP community.Watch a video on how to find out about the upcoming cryptocurrency pump and earn huge profits.

These trading signals help earn huge profit in just a few hours after purchasing the coins published on the Telegram channel.Are you already making a profit using these trading signals? If not, then try it!We wish you good luck in trading cryptocurrency and wish to receive the same profit as VIP subscribers of the Crypto Pump Signals for Binance channel.